Key takeaways

When dealing with a Wyoming Promissory Note, understanding its components and implications is crucial. Here are some key takeaways to consider:

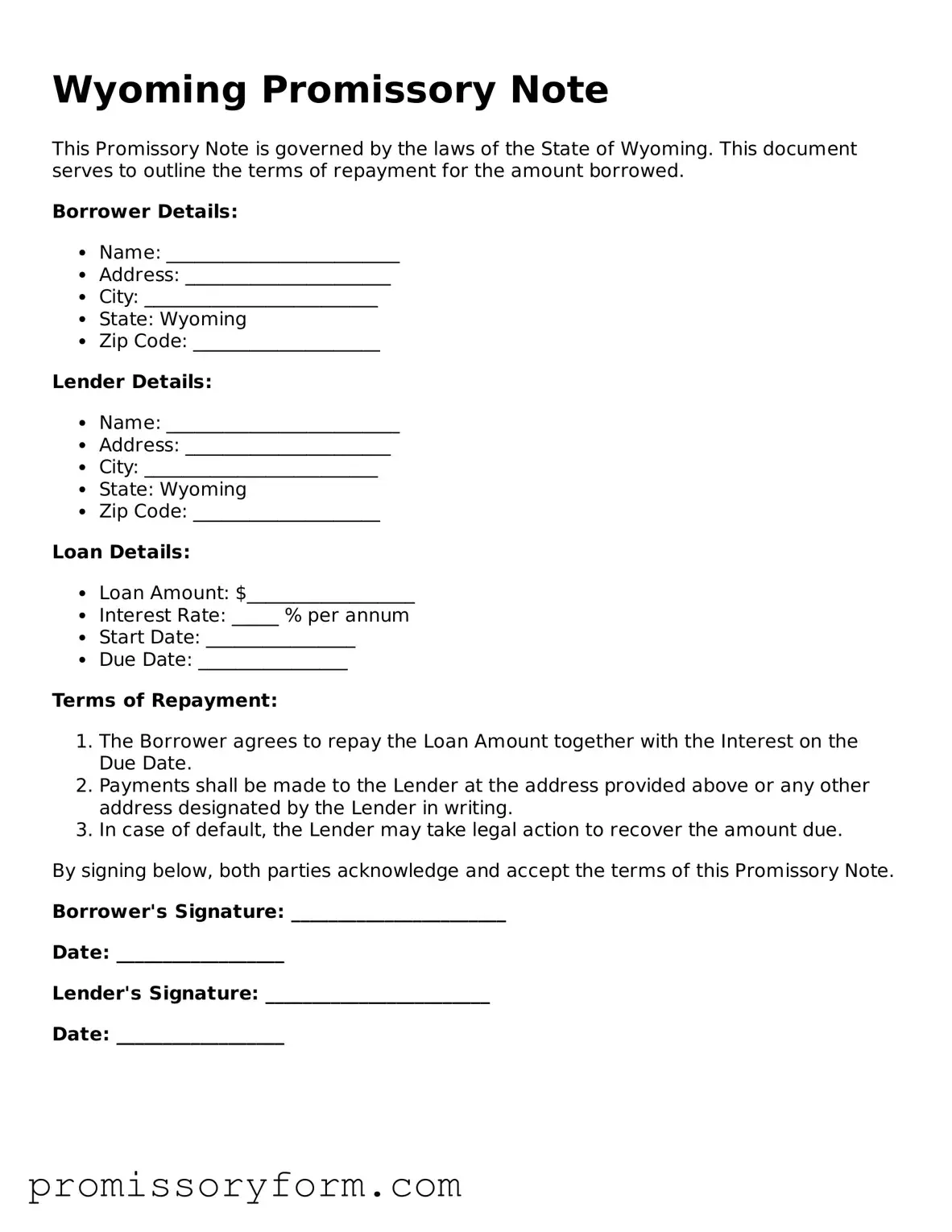

- Clear Identification: Clearly identify the parties involved. This includes the lender and the borrower, along with their addresses.

- Loan Amount: Specify the exact amount of money being borrowed. This should be a precise figure to avoid confusion.

- Interest Rate: Indicate the interest rate applicable to the loan. This can be fixed or variable, but it must be clearly stated.

- Repayment Terms: Outline the repayment schedule. This includes the frequency of payments (monthly, quarterly, etc.) and the due date for each payment.

- Late Fees: Detail any penalties for late payments. This can encourage timely repayment and protect the lender's interests.

- Prepayment Options: Consider including terms regarding prepayment. Borrowers may want the option to pay off the loan early without penalties.

- Governing Law: State that Wyoming law governs the agreement. This provides clarity regarding legal interpretations and enforcement.

- Signatures: Ensure that both parties sign the note. Without signatures, the document may not be enforceable.

- Witnesses or Notary: While not always required, having a witness or notary public can add an extra layer of authenticity.

- Record Keeping: Keep a copy of the signed note for your records. This is important for future reference and any potential disputes.

By following these guidelines, both lenders and borrowers can navigate the process of creating and utilizing a Wyoming Promissory Note with greater confidence and clarity.