Key takeaways

When filling out and using the Wisconsin Promissory Note form, it is essential to understand its key components and implications. Here are ten important takeaways:

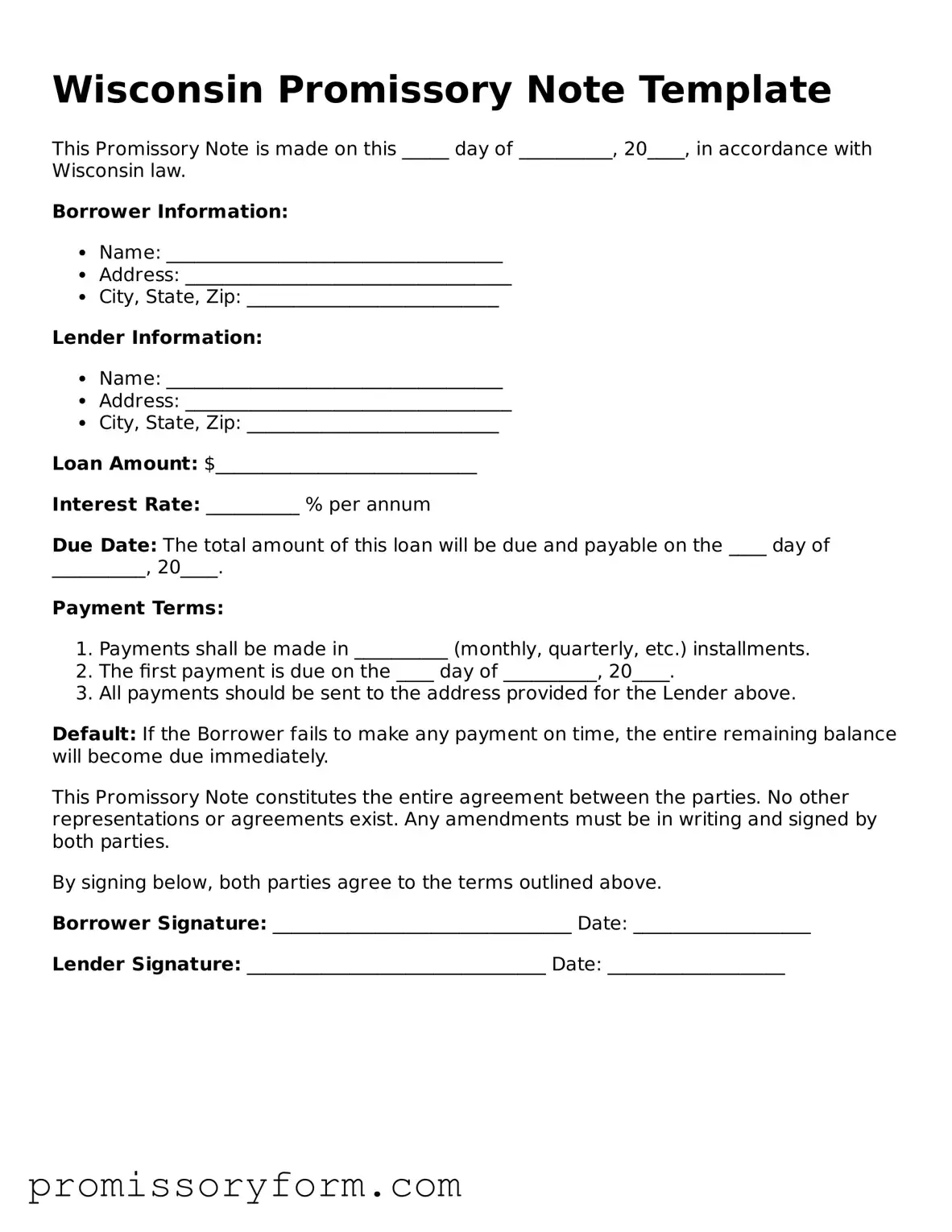

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that both parties are properly identified.

- Loan Amount: Specify the exact amount of money being borrowed. This figure should be accurate to avoid future disputes.

- Interest Rate: Include the interest rate, if applicable. This can be a fixed or variable rate, and it must comply with Wisconsin law.

- Repayment Terms: Outline how and when the borrower will repay the loan. This includes payment frequency and due dates.

- Late Fees: If there are penalties for late payments, these should be clearly stated in the note.

- Prepayment Clause: Indicate whether the borrower can pay off the loan early without penalty. This provides flexibility for the borrower.

- Governing Law: The note should specify that it is governed by Wisconsin law. This clarifies which legal framework applies to the agreement.

- Signatures: Both the borrower and lender must sign the document. This indicates their agreement to the terms outlined.

- Witness or Notary: Consider having the document witnessed or notarized. This adds an extra layer of authenticity and can help in legal enforcement.

- Keep Copies: After signing, both parties should keep copies of the promissory note. This ensures that everyone has access to the terms agreed upon.

Understanding these key points can help both borrowers and lenders navigate the process of creating a promissory note in Wisconsin. It is always wise to consult with a legal expert if there are any uncertainties.