Key takeaways

Here are some key takeaways about filling out and using the West Virginia Promissory Note form:

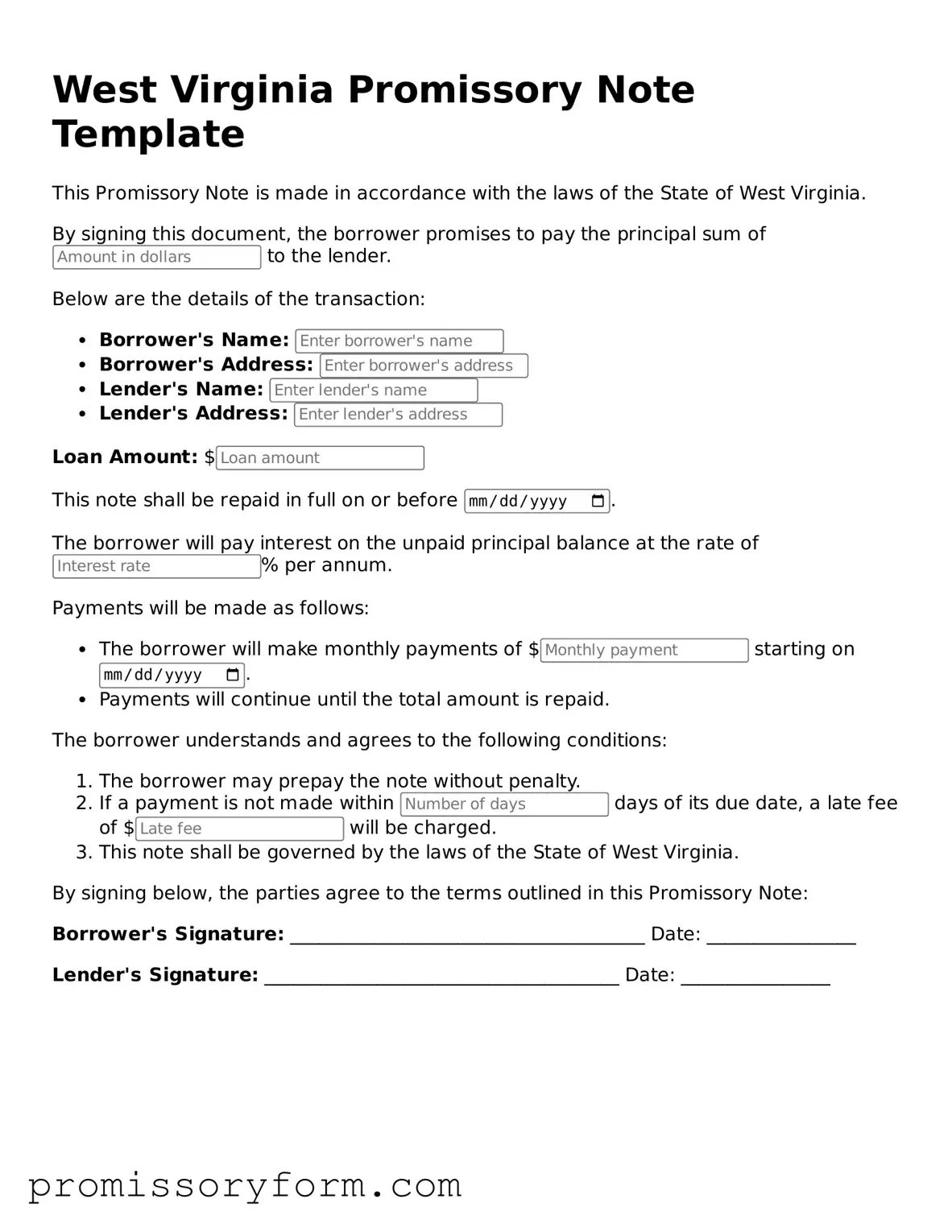

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan to a lender.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender at the beginning of the document.

- Specify the Loan Amount: Clearly indicate the total amount of money being borrowed.

- Detail the Interest Rate: If applicable, include the interest rate. Make sure it complies with West Virginia laws.

- Set the Repayment Terms: Outline how and when the borrower will repay the loan, including due dates and payment frequency.

- Include Late Fees: If there are penalties for late payments, specify them in the note.

- Signatures are Essential: Both the borrower and lender must sign the document for it to be legally binding.

- Consider Witnesses or Notarization: Although not always required, having a witness or notarizing the document can add an extra layer of security.

- Keep Copies: Each party should keep a signed copy of the promissory note for their records.

- Consult Legal Advice if Needed: If unsure about any aspect of the note, seeking legal advice can be beneficial.