Key takeaways

Filling out and using the Washington Promissory Note form requires attention to detail and an understanding of its components. Below are key takeaways that can guide individuals through the process.

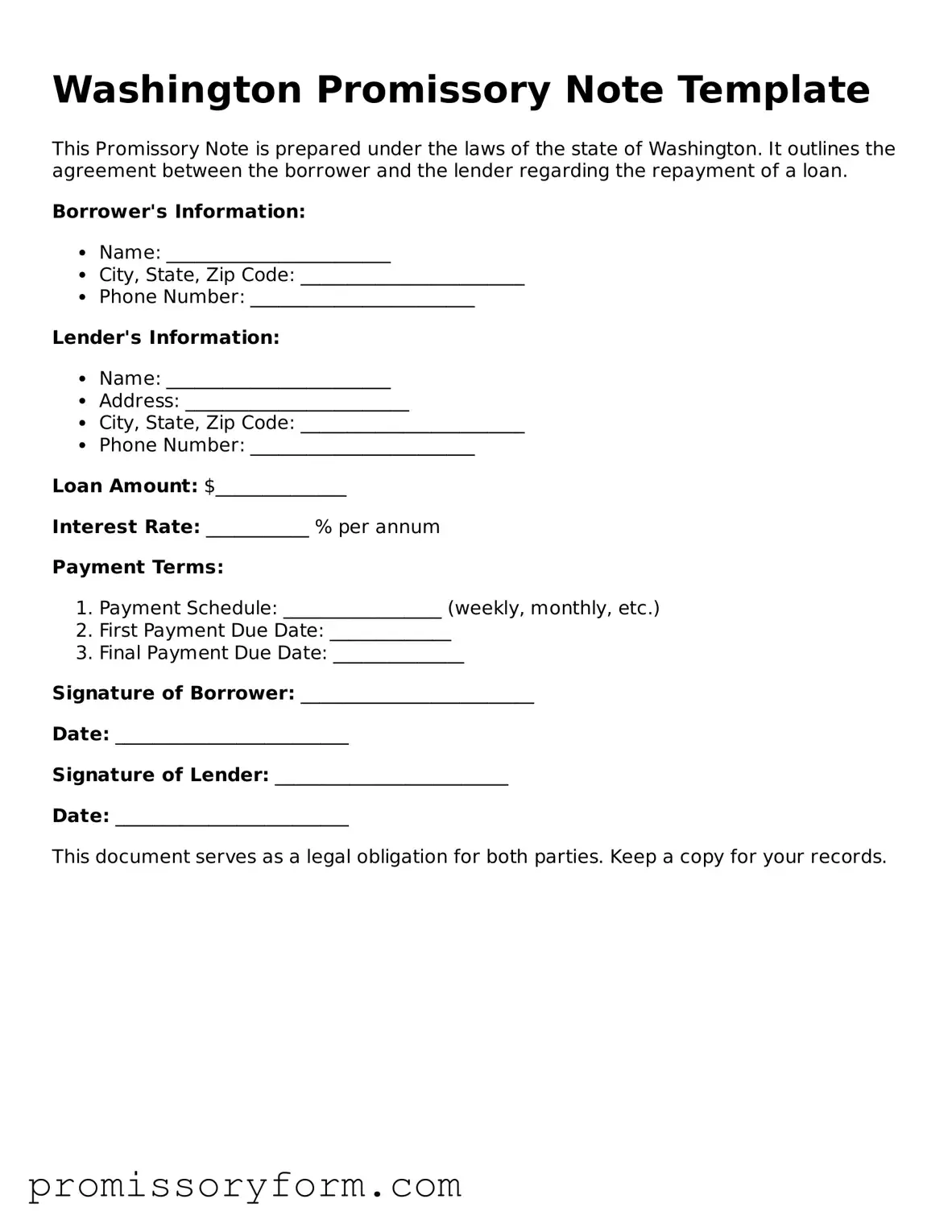

- Understand the Purpose: A promissory note is a written promise to pay a specified amount of money to a designated person or entity.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This establishes who is involved in the agreement.

- Specify the Amount: Indicate the exact amount of money being borrowed. This figure should be clear to avoid any confusion.

- Detail the Terms: Include the repayment terms, such as the interest rate, payment schedule, and due dates. Clarity in these terms is crucial.

- Include Late Fees: If applicable, specify any penalties for late payments. This encourages timely repayment.

- Consider Collateral: If the loan is secured, describe the collateral. This provides security for the lender.

- Signature Requirement: Ensure that both parties sign the document. A signature signifies agreement to the terms outlined in the note.

- Consult Legal Standards: Familiarize yourself with Washington state laws governing promissory notes. Compliance with these laws is essential for enforceability.

- Keep Copies: After completion, retain copies of the signed note for both parties. This ensures that both have access to the agreement.

- Review Before Signing: Both parties should thoroughly review the document before signing. This helps prevent misunderstandings and disputes in the future.

By following these guidelines, individuals can effectively fill out and utilize the Washington Promissory Note form, ensuring a clear and enforceable agreement.