Key takeaways

When filling out and using the Virginia Promissory Note form, keep the following key points in mind:

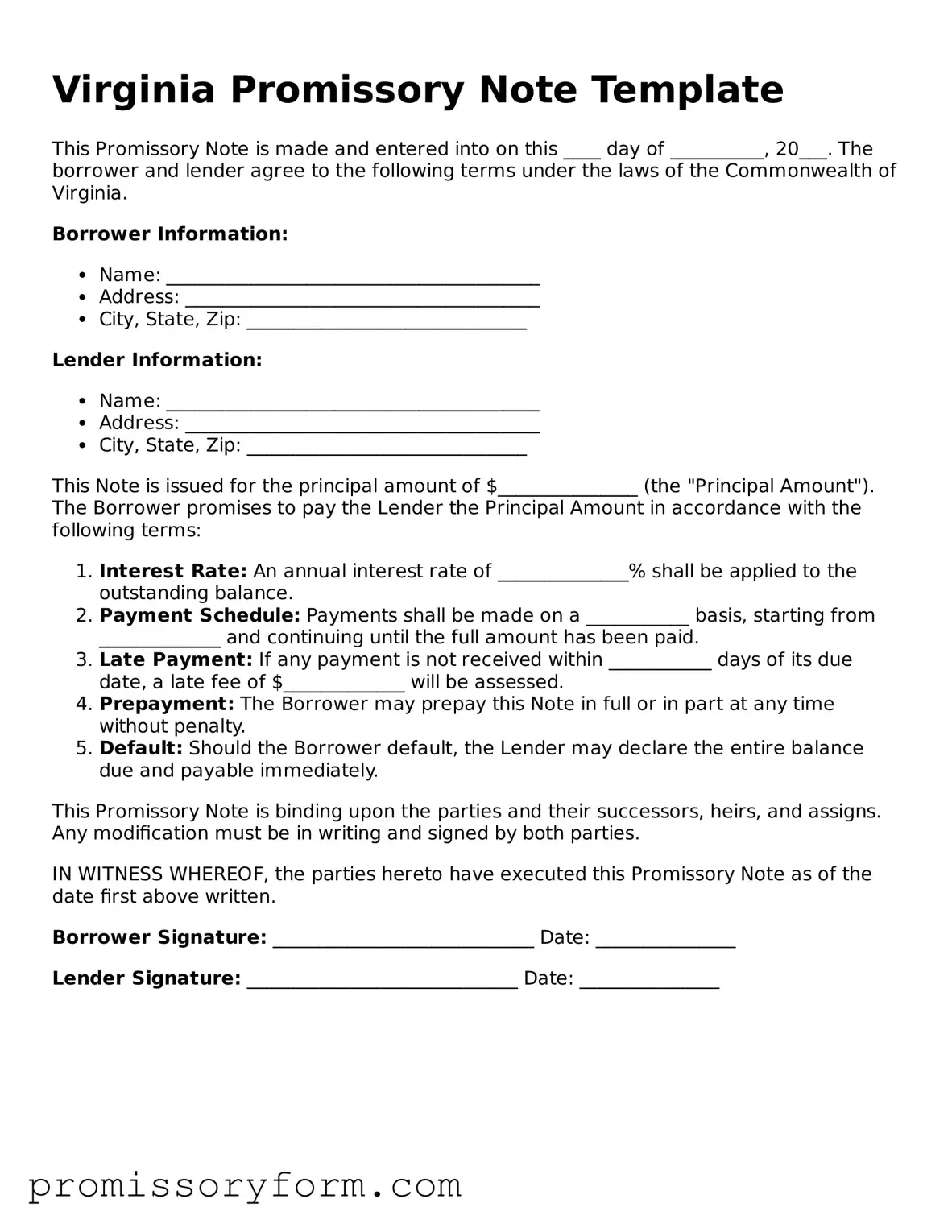

- Understand the Purpose: A promissory note is a legal document that outlines a promise to pay a specific amount of money at a specified time.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This information is crucial for legal identification.

- Specify the Loan Amount: Clearly indicate the total amount of money being borrowed. This should be a precise figure.

- Set the Interest Rate: If applicable, include the interest rate for the loan. Make sure it complies with Virginia’s usury laws.

- Outline the Payment Terms: Describe how and when payments will be made. This can include monthly installments or a lump-sum payment.

- Include a Maturity Date: Specify when the loan must be fully repaid. This date is essential for both parties to understand their obligations.

- State Default Conditions: Clearly outline what constitutes a default on the loan. This can include missed payments or failure to adhere to terms.

- Consider Collateral: If the loan is secured, specify what collateral will back the loan. This provides security for the lender.

- Signature Requirements: Ensure that both parties sign the document. This signifies agreement to the terms outlined in the note.

- Keep Copies: After signing, make copies of the promissory note for both the borrower and lender. This ensures that both parties have a record of the agreement.

By following these guidelines, you can effectively complete the Virginia Promissory Note form and protect the interests of both parties involved in the transaction.