Key takeaways

Here are some important points to consider when filling out and using the Vermont Promissory Note form:

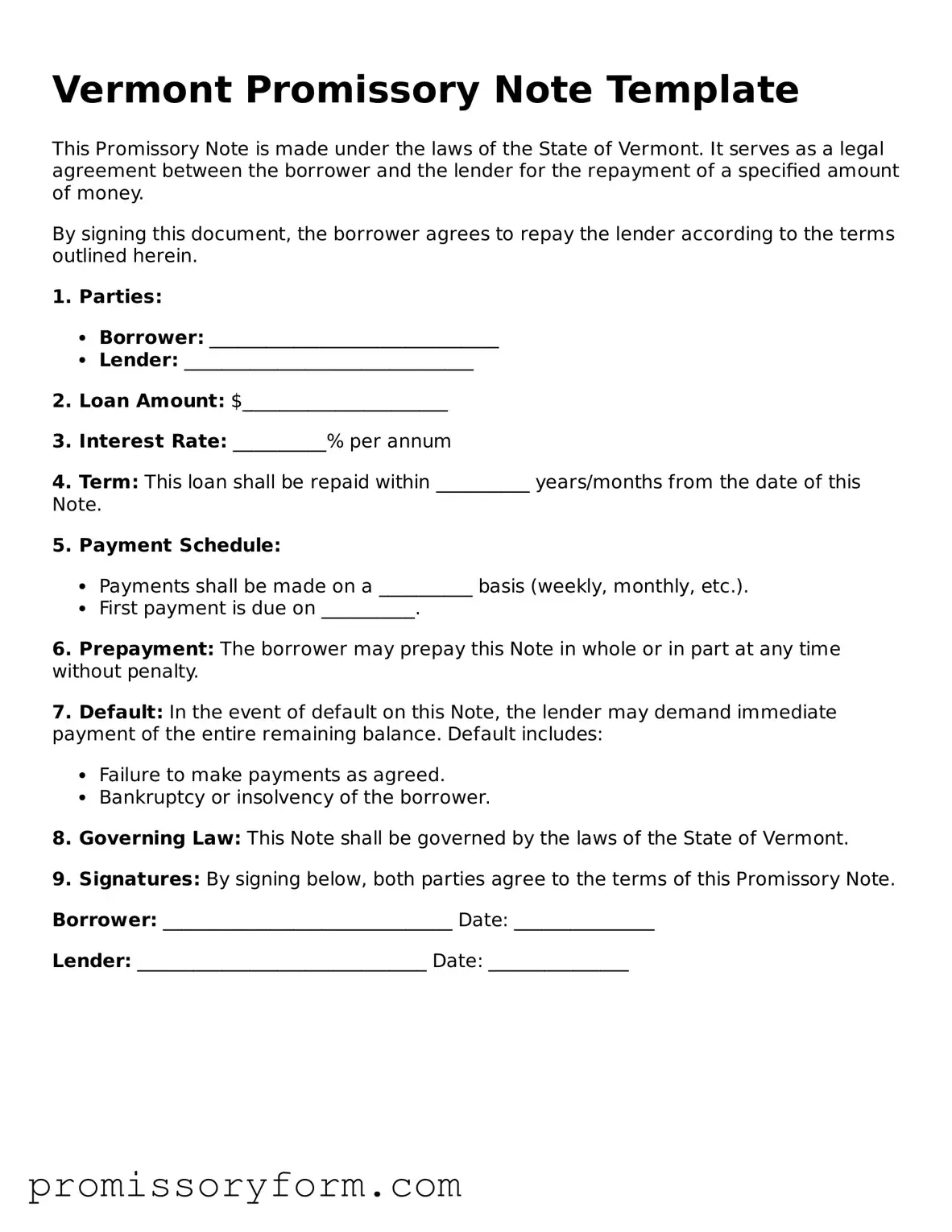

- Understand the Purpose: A promissory note is a written promise to pay a specific amount of money to someone at a certain time.

- Identify the Parties: Clearly list the names and addresses of both the borrower and the lender.

- Specify the Loan Amount: Clearly state the total amount of money being borrowed.

- Include Interest Rate: If applicable, mention the interest rate and whether it is fixed or variable.

- Set Payment Terms: Outline how and when the borrower will make payments. Include due dates and payment amounts.

- Define Default Terms: Explain what happens if the borrower fails to make payments on time.

- Include Signatures: Both the borrower and lender must sign the document for it to be legally binding.

- Consider Notarization: Although not always required, having the document notarized can add an extra layer of protection.

- Keep Copies: Both parties should keep a signed copy of the promissory note for their records.

- Consult Legal Advice: If unsure about any terms, it may be wise to consult a legal professional before finalizing the document.