Key takeaways

When dealing with a Utah Promissory Note, understanding the key elements can help ensure that the document serves its intended purpose effectively. Here are some important takeaways to consider:

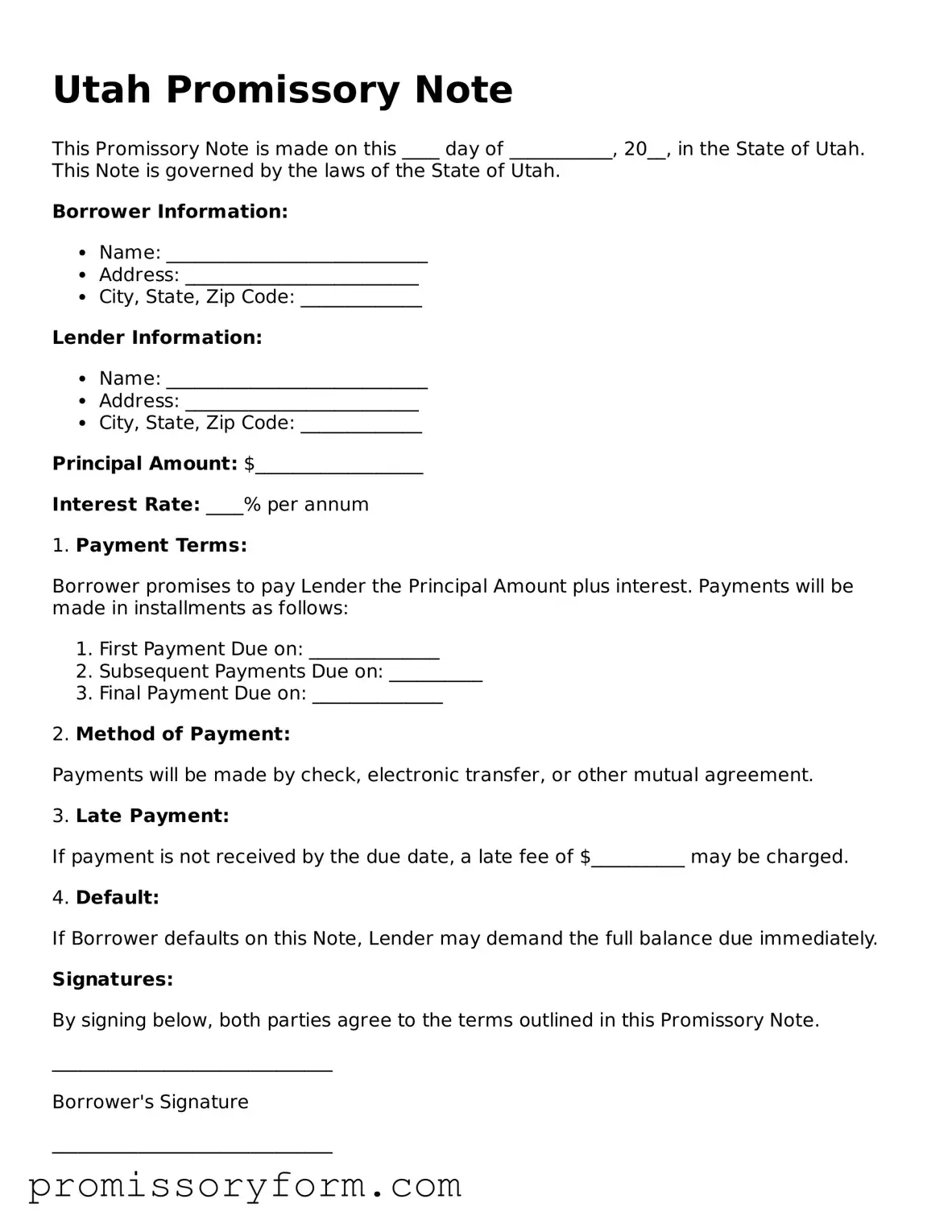

- Clear Identification: Clearly identify the parties involved, including the lender and borrower, to avoid any confusion regarding obligations.

- Loan Amount: Specify the exact amount of money being borrowed. This figure must be precise to prevent disputes.

- Interest Rate: Include the interest rate, if applicable. This rate should comply with Utah’s usury laws to remain enforceable.

- Payment Terms: Outline the repayment schedule, including the frequency of payments and due dates, to establish clear expectations.

- Default Conditions: Define what constitutes a default. This may include late payments or failure to meet other terms of the agreement.

- Governing Law: State that the note is governed by Utah law, which provides a framework for resolving any disputes that may arise.

- Signatures: Ensure that both parties sign the document. This step is crucial for the note’s validity and enforceability.

- Witness or Notary: While not always required, having a witness or notary can add an extra layer of legitimacy to the agreement.

- Record Keeping: Keep a copy of the signed note for personal records. This documentation is vital in case of future disputes or clarifications.

By adhering to these guidelines, individuals can create a comprehensive and enforceable Utah Promissory Note that protects the interests of all parties involved.