Key takeaways

Filling out and using the Texas Promissory Note form requires attention to detail. Here are key takeaways to consider:

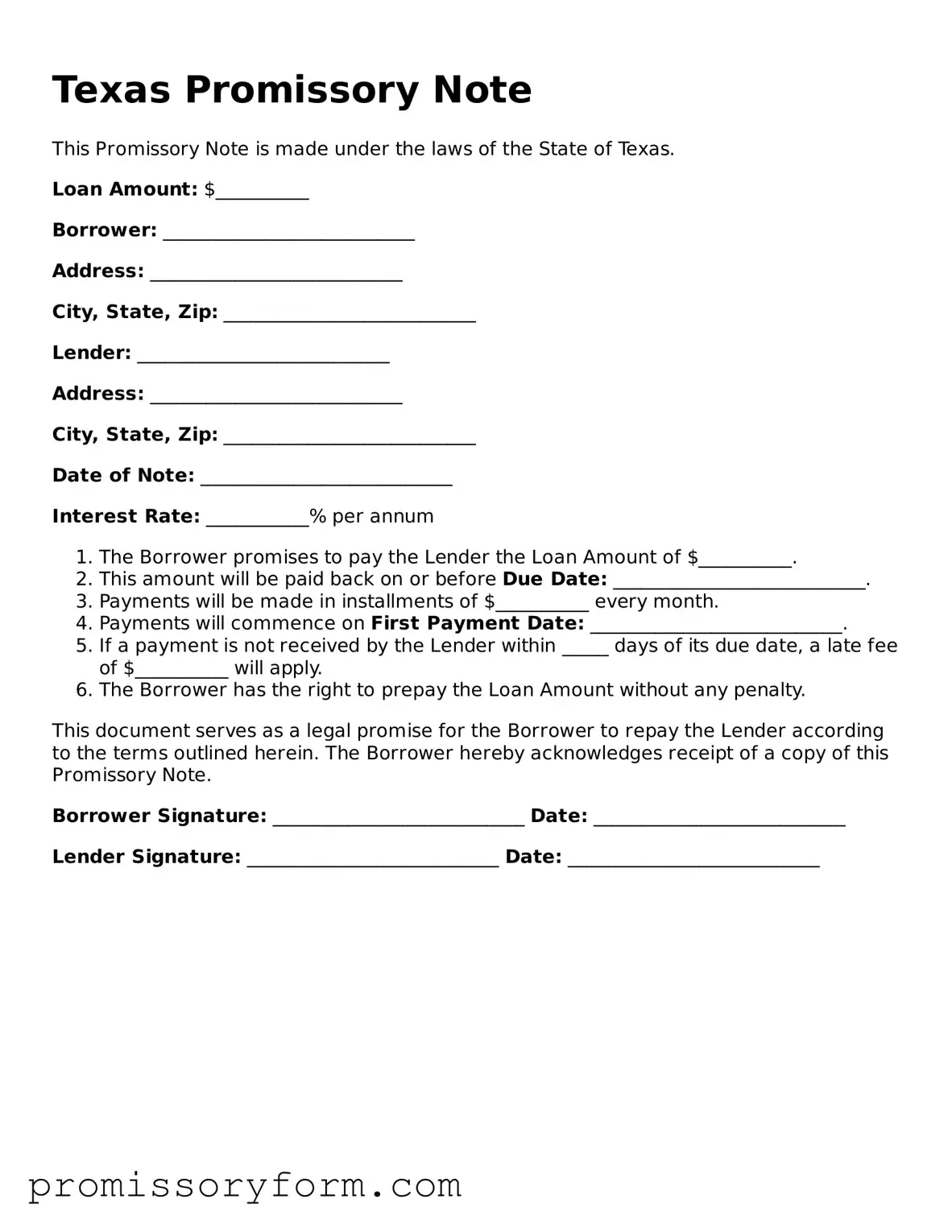

- Ensure that all parties involved are clearly identified with their full legal names.

- Specify the loan amount in both numerical and written form to avoid confusion.

- Outline the interest rate, if applicable, and ensure it complies with Texas laws.

- Clearly state the repayment schedule, including due dates and payment amounts.

- Include a section for late fees, if any, to encourage timely payments.

- Address what happens in case of default, including any potential remedies.

- Provide space for signatures of all parties to make the document legally binding.

- Consider having the document notarized for added legal protection.

- Keep a copy of the signed note for your records and provide one to the borrower.

- Review the document for accuracy before finalizing to prevent future disputes.

Understanding these points will help ensure that the Texas Promissory Note is filled out correctly and serves its intended purpose.