Key takeaways

When filling out and using the Tennessee Promissory Note form, there are several important aspects to keep in mind. The following key takeaways will help ensure that the process is smooth and compliant.

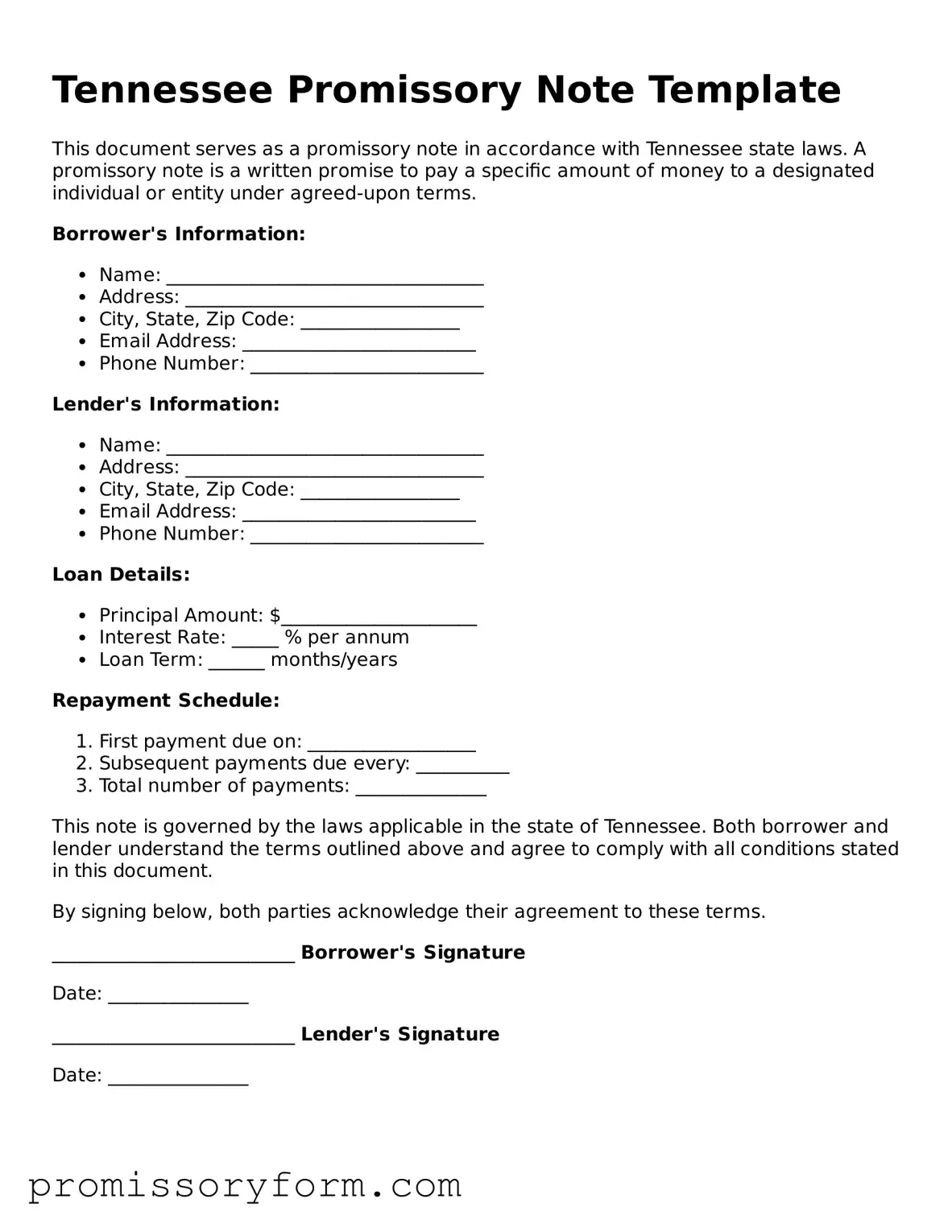

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan to the lender under specified terms.

- Include Essential Information: Ensure that the note contains the borrower's name, lender's name, loan amount, interest rate, repayment schedule, and any other relevant terms.

- Specify the Interest Rate: Clearly state whether the interest is fixed or variable. This will affect the total amount repaid over time.

- Payment Terms Matter: Detail the payment schedule, including due dates and the method of payment. This helps avoid misunderstandings later.

- Consider Default Terms: Include clauses that outline what happens in the event of a default. This can protect the lender's interests.

- Signatures Are Required: Both the borrower and lender must sign the document. This validates the agreement and makes it enforceable in court.

By following these guidelines, you can effectively use the Tennessee Promissory Note form to create a clear and enforceable loan agreement.