Key takeaways

When filling out and using the South Dakota Promissory Note form, it is important to understand the key elements involved. Here are some essential takeaways:

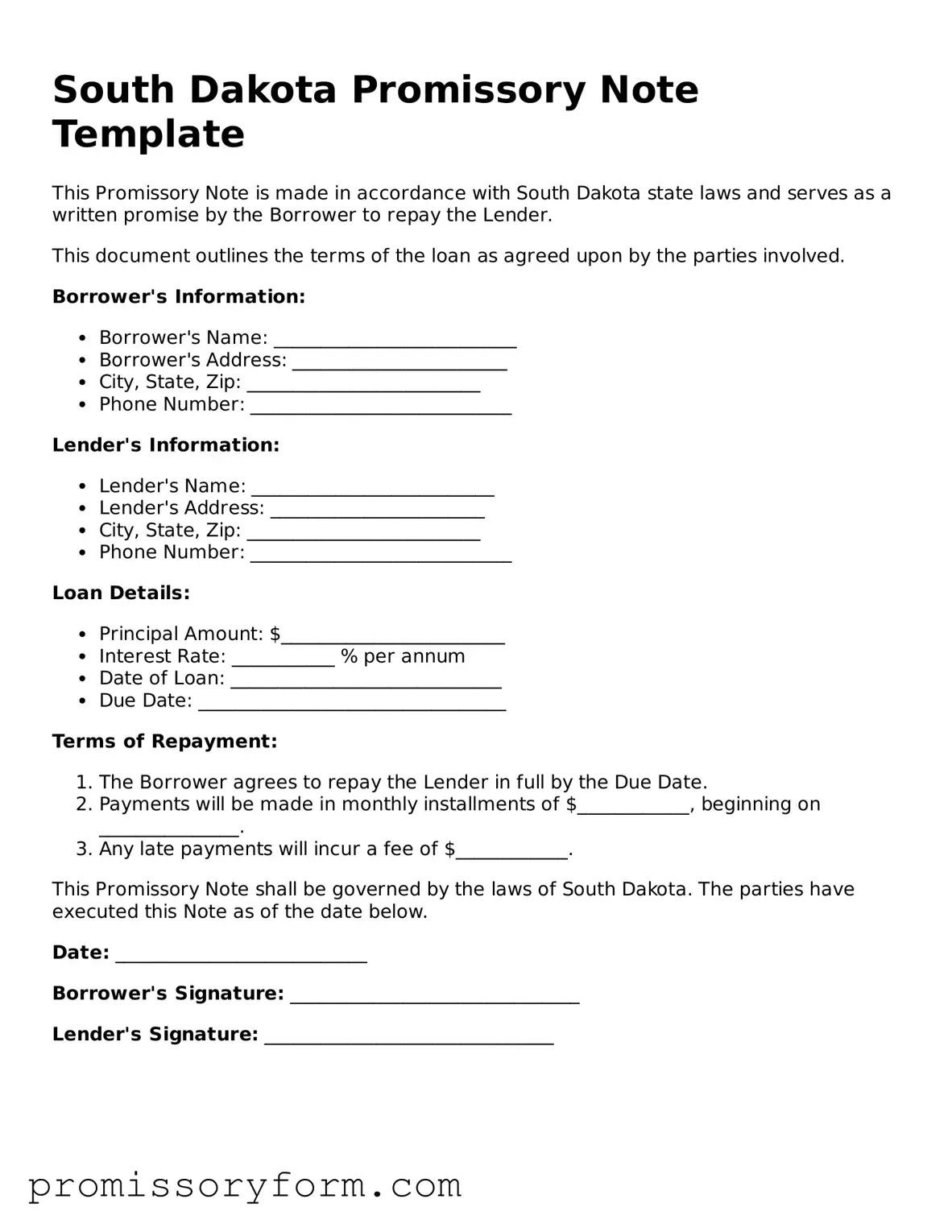

- Understand the Purpose: A promissory note is a legal document that outlines a promise to pay a specific amount of money to a designated person or entity.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that all parties are properly identified.

- Specify the Amount: Clearly indicate the total amount of money being borrowed. This figure should be precise to avoid confusion.

- Set the Interest Rate: If applicable, include the interest rate on the loan. This can be fixed or variable, but it must be clearly defined.

- Outline the Payment Terms: Detail how and when payments will be made. This includes the frequency of payments and the due dates.

- Include a Maturity Date: State when the loan must be fully repaid. This date is crucial for both parties to understand the timeline.

- Consider Default Terms: Define what happens if the borrower fails to make payments. This may include late fees or legal action.

- Signatures Required: Both the borrower and lender must sign the document. This signifies agreement to the terms laid out in the note.

- Keep Copies: After the note is signed, both parties should retain copies for their records. This is important for future reference.

By following these guidelines, you can ensure that the South Dakota Promissory Note is filled out correctly and serves its intended purpose effectively.