Key takeaways

When filling out and using the South Carolina Promissory Note form, it’s important to keep several key points in mind. Here’s a list of essential takeaways:

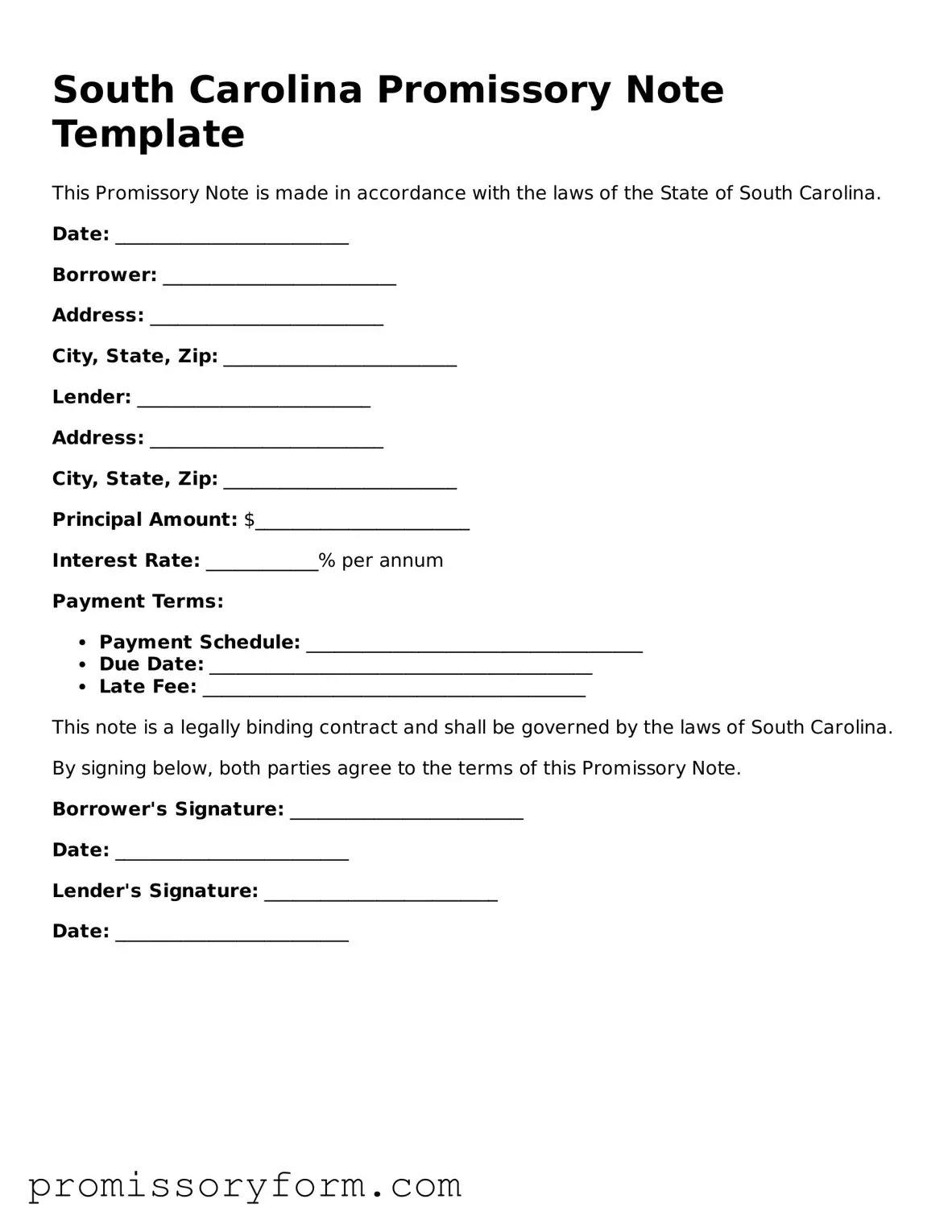

- Understand the Purpose: A promissory note is a written promise to pay a specific amount of money to a designated person or entity.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that all parties are easily identifiable.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This is crucial for clarity and legal enforceability.

- Detail the Interest Rate: If applicable, include the interest rate. Be sure to specify whether it is fixed or variable.

- Set the Repayment Terms: Outline how and when the borrower will repay the loan. Include specific dates or intervals for payments.

- Include Default Terms: Clearly state what happens if the borrower fails to make payments. This can include late fees or acceleration of the loan.

- Signatures Required: Ensure that both parties sign the document. A signature indicates agreement to the terms outlined in the note.

- Consider Notarization: While not always necessary, having the document notarized can provide additional legal protection.

- Keep Copies: After signing, both the borrower and lender should keep copies of the promissory note for their records.

- Consult Legal Advice: If unsure about any aspect of the note, consider seeking legal advice to ensure compliance with South Carolina laws.

By following these guidelines, you can effectively create and utilize a promissory note that meets your needs and protects your interests.