Key takeaways

When filling out and using the Rhode Island Promissory Note form, keep the following key takeaways in mind:

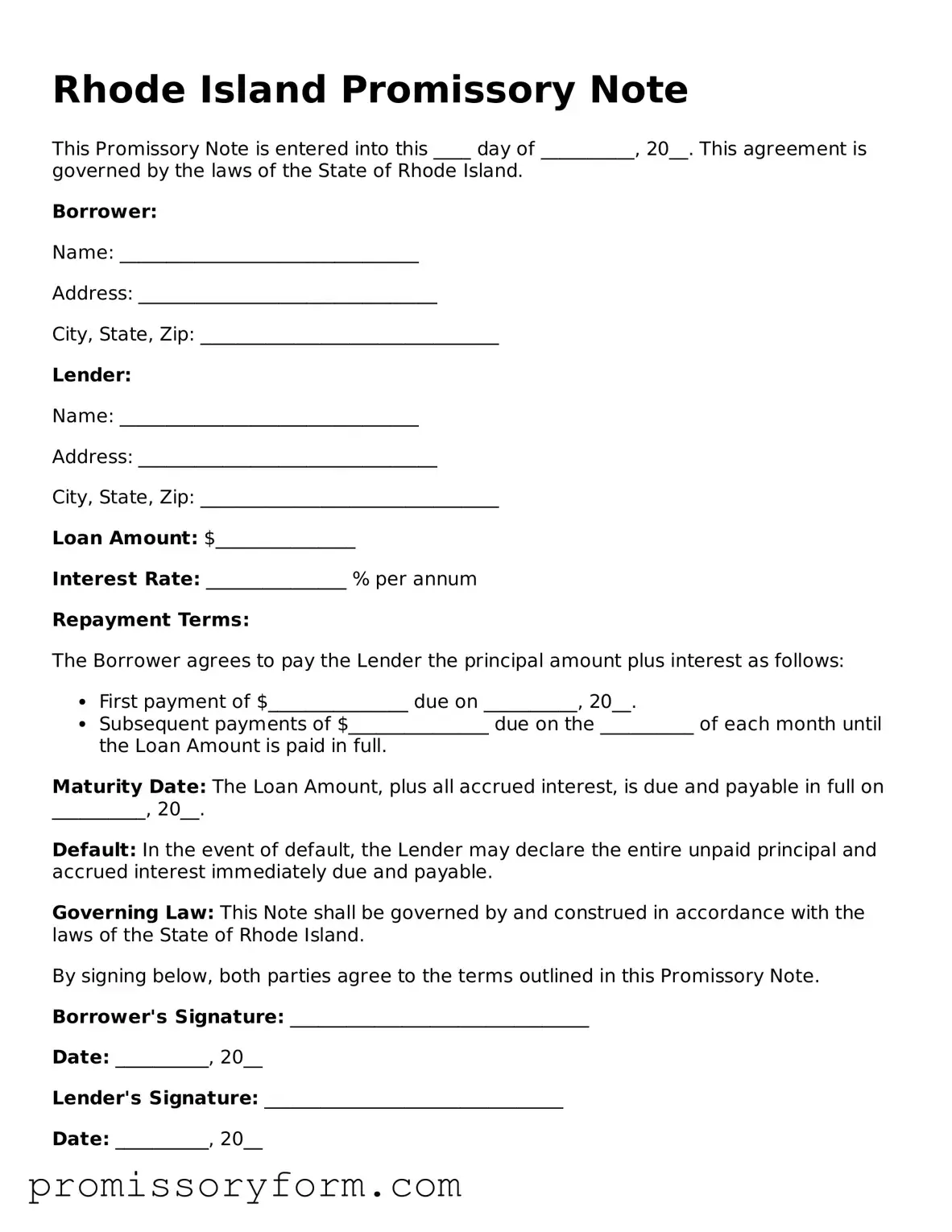

- Understand the Basics: A promissory note is a written promise to pay a specific amount of money at a defined time.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender.

- Specify the Amount: Clearly indicate the total loan amount in both numbers and words to avoid any confusion.

- Include Interest Rate: If applicable, specify the interest rate, whether it’s fixed or variable.

- Payment Terms: Outline the repayment schedule, including due dates and payment amounts.

- Late Fees: Consider including terms for late payments, such as fees or penalties.

- Default Conditions: Clearly define what constitutes a default and the lender's rights in that event.

- Governing Law: State that Rhode Island law governs the promissory note, ensuring clarity on legal jurisdiction.

- Signatures Required: Ensure both parties sign and date the document to make it legally binding.

- Keep Copies: Retain copies of the signed note for both the borrower and lender for future reference.

By following these key points, you can effectively utilize the Rhode Island Promissory Note form and ensure a clear agreement between parties.