Key takeaways

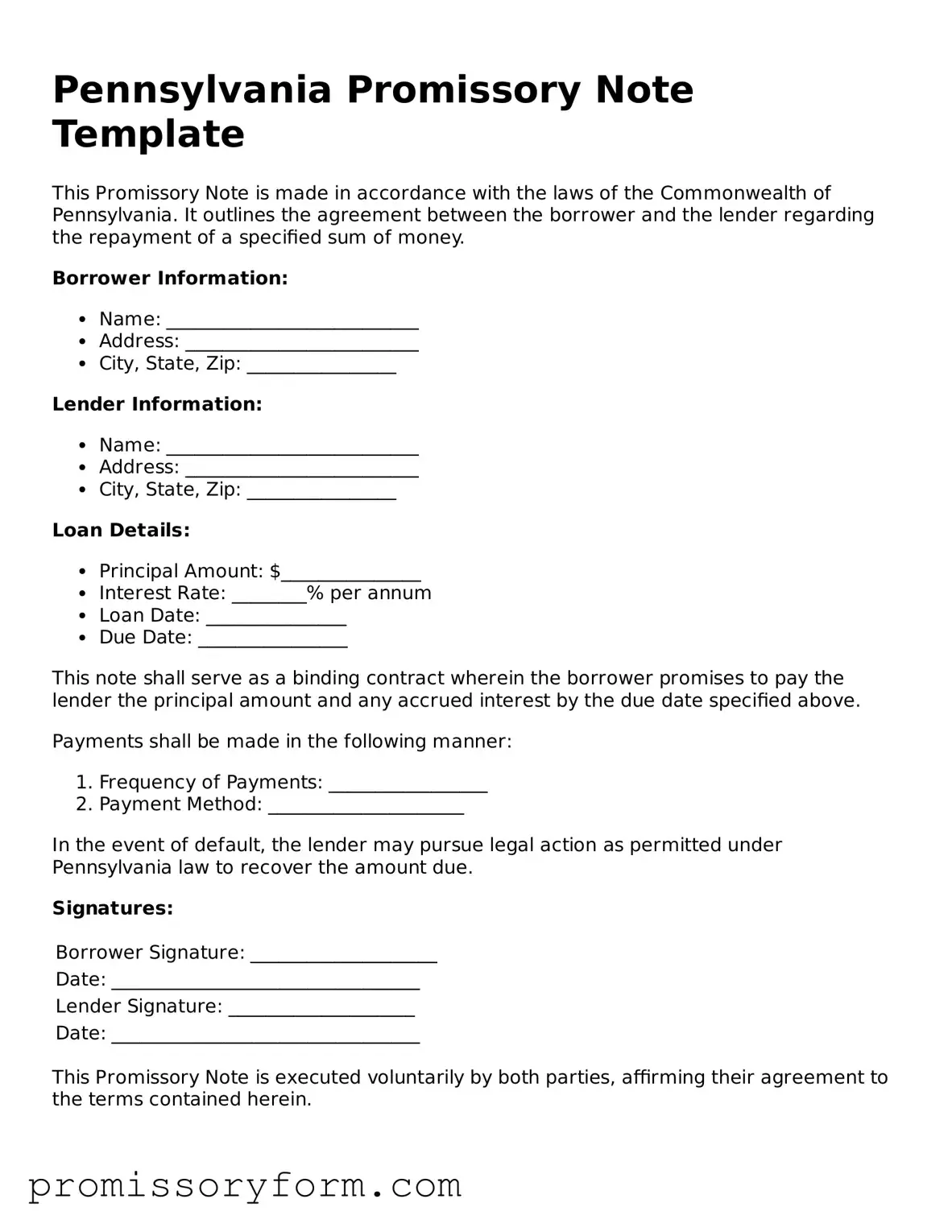

Ensure that all parties involved are clearly identified. This includes the borrower and the lender. Use full legal names to avoid confusion.

Specify the loan amount in both numerical and written form. This helps prevent misunderstandings about the total amount borrowed.

Clearly outline the interest rate. If the loan is interest-bearing, state whether the rate is fixed or variable.

Include the repayment schedule. Detail how and when payments will be made. This could be monthly, quarterly, or another agreed-upon timeline.

Address late fees or penalties for missed payments. This can encourage timely payments and clarify consequences for the borrower.

Have both parties sign the document. Signatures validate the agreement and confirm that both parties understand the terms.

Consider having the document notarized. While not always required, notarization adds an extra layer of authenticity and can be helpful in legal situations.