Key takeaways

When filling out and using the Oklahoma Promissory Note form, it is essential to understand several key aspects. Below are ten important takeaways:

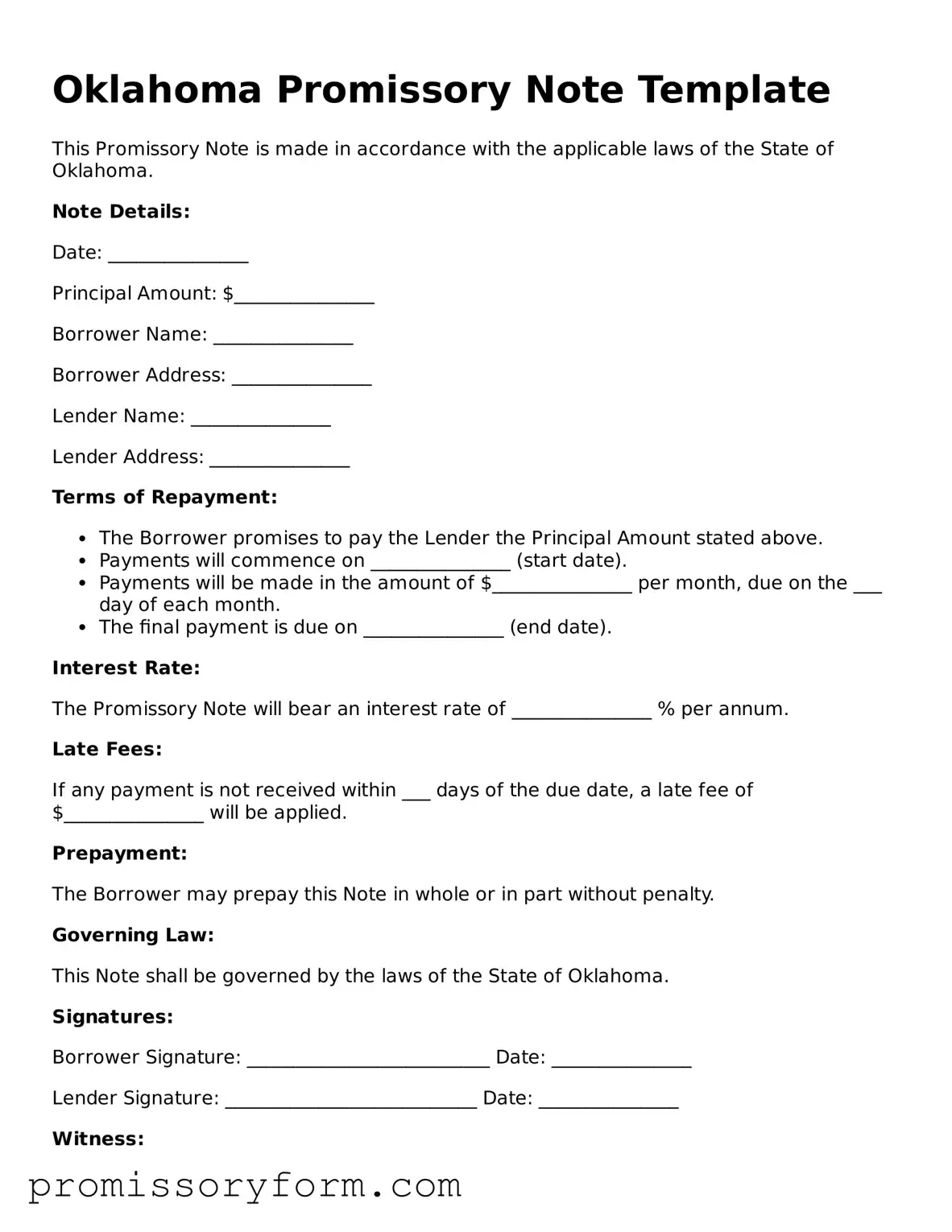

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This establishes who is involved in the agreement.

- Loan Amount: Specify the exact amount being borrowed. This figure must be accurate and clearly indicated.

- Interest Rate: Include the interest rate applicable to the loan. If there is no interest, state that explicitly.

- Payment Terms: Outline how and when payments will be made. Include the frequency of payments and the due date for each installment.

- Maturity Date: Indicate when the loan will be fully repaid. This date is crucial for both parties to know.

- Late Fees: Specify any late fees that will apply if payments are not made on time. This encourages timely payments.

- Prepayment Clause: State whether the borrower can pay off the loan early without penalties. This can be beneficial for borrowers.

- Governing Law: Note that the agreement is governed by Oklahoma law. This is important for legal enforcement.

- Signatures: Ensure both parties sign the document. Without signatures, the note is not legally binding.

- Keep Copies: Each party should retain a signed copy of the note. This protects both parties and serves as a reference.

Understanding these elements will help ensure that the Promissory Note is clear, enforceable, and protects the interests of both the borrower and lender.