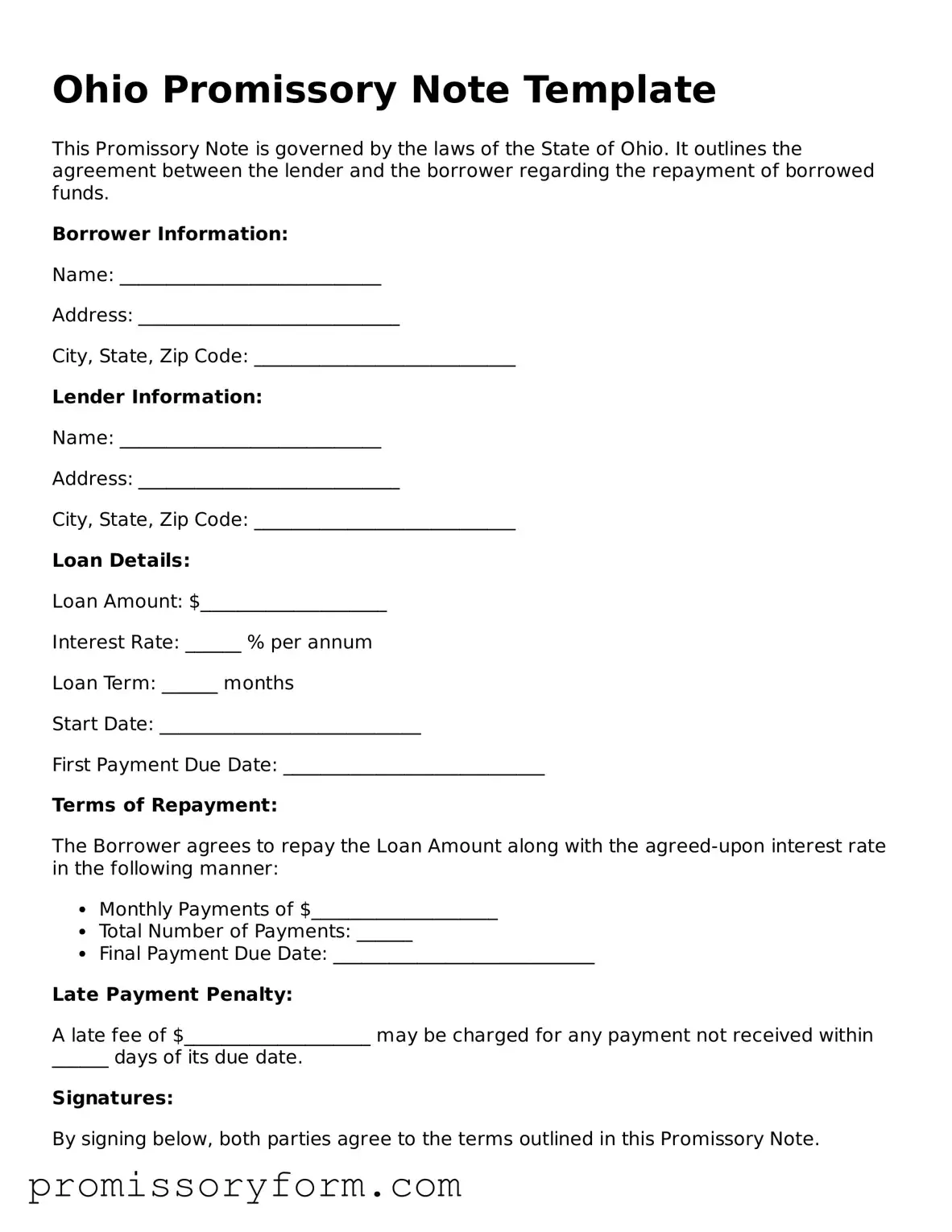

Filling out the Ohio Promissory Note form can seem straightforward, but many individuals encounter pitfalls that can lead to complications. One common mistake is failing to clearly state the names of the parties involved. It is essential to include the full legal names of both the borrower and the lender. Incomplete or incorrect names can create confusion and may complicate enforcement of the note.

Another frequent error is neglecting to specify the loan amount. While it might seem obvious, writing the amount in both numerical and written form is crucial. This redundancy helps prevent misunderstandings about the loan's value. If only one format is used, it could lead to disputes later on.

People often overlook the importance of detailing the interest rate. Without a clearly defined interest rate, the note may be deemed invalid or unenforceable. It is advisable to include whether the interest is fixed or variable and to specify how it will be calculated. This clarity protects both parties and ensures mutual understanding.

Additionally, individuals may forget to outline the repayment schedule. A vague repayment plan can lead to confusion and disputes down the line. Clearly stating when payments are due, the frequency of payments, and the duration of the loan helps establish expectations and accountability.

Some borrowers mistakenly assume that a signature is the only requirement for validity. However, both parties must sign the document. Without the lender's signature, the note may not hold up in court. Ensuring that all necessary signatures are present is vital for the enforceability of the agreement.

Another common mistake involves the lack of a default clause. A default clause outlines the consequences if the borrower fails to make payments. Omitting this information can leave both parties in a precarious position if issues arise. Including clear terms regarding default can provide protection and clarity.

People sometimes neglect to include a date on the Promissory Note. A date is critical as it establishes when the agreement was made and can affect the timeline for repayment. Without a date, it can be challenging to determine the start of the repayment period.

Moreover, individuals may not consider the need for witnesses or notarization. While not always required, having a witness or notarizing the document can add an extra layer of legitimacy. This step can be particularly beneficial in case of disputes, as it provides additional proof of the agreement.

Some may also fail to keep copies of the signed document. It is important for both parties to retain a copy for their records. This ensures that each party has access to the terms of the agreement and can refer back to it if any questions or disputes arise.

Lastly, people often do not seek legal advice before finalizing the note. While it might seem unnecessary, consulting with a legal professional can help identify potential issues and ensure that the document complies with Ohio law. A little foresight can save significant time and trouble in the future.