Completing a North Dakota Promissory Note form requires careful attention to detail. Many individuals inadvertently make mistakes that can lead to confusion or even legal issues down the line. Understanding these common errors can help ensure that the document is filled out correctly.

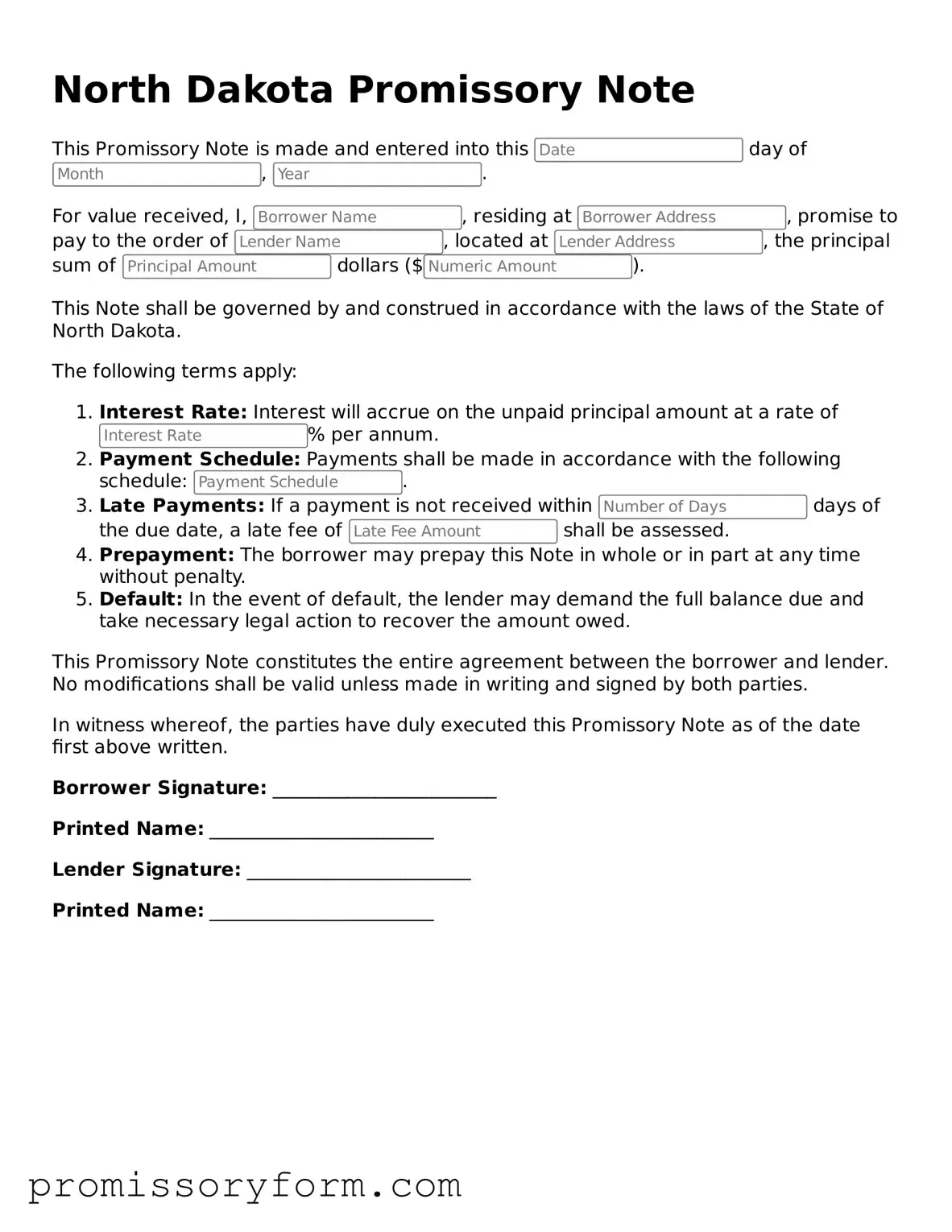

One frequent mistake is failing to include all necessary parties. The form should clearly identify both the borrower and the lender. Omitting one of the parties can result in an incomplete agreement, which may complicate enforcement if issues arise.

Another common error involves incorrect amounts. It is crucial to accurately state the principal amount being borrowed. Even a small discrepancy can lead to misunderstandings or disputes later. Double-checking numerical entries can prevent these issues.

Additionally, some individuals neglect to specify the interest rate. Without this information, the agreement may lack clarity regarding repayment terms. It is essential to indicate whether the interest is fixed or variable and to provide the exact rate to avoid ambiguity.

People often overlook the repayment schedule. The form should clearly outline when payments are due, whether they are monthly, quarterly, or on another schedule. Failing to include this detail can lead to confusion about when obligations must be met.

Another mistake is not signing the document. A Promissory Note is not valid unless it is signed by the borrower. In some cases, individuals may forget to sign or may not have a witness present, which can undermine the enforceability of the note.

Some individuals also fail to date the document. A date is essential as it establishes when the agreement was made. Without a date, it may be challenging to determine the timeline for repayment or any associated deadlines.

Moreover, people sometimes do not read the entire document before signing. This oversight can lead to unexpected obligations or terms that were not fully understood. Taking the time to review all sections of the form is vital to ensure that all terms are acceptable.

Lastly, individuals may ignore state-specific requirements. Each state has its own laws regarding Promissory Notes, and North Dakota is no exception. It is important to ensure that the form complies with local regulations to avoid potential legal issues.