Key takeaways

When filling out and using the New York Promissory Note form, there are several important points to keep in mind. Here are five key takeaways:

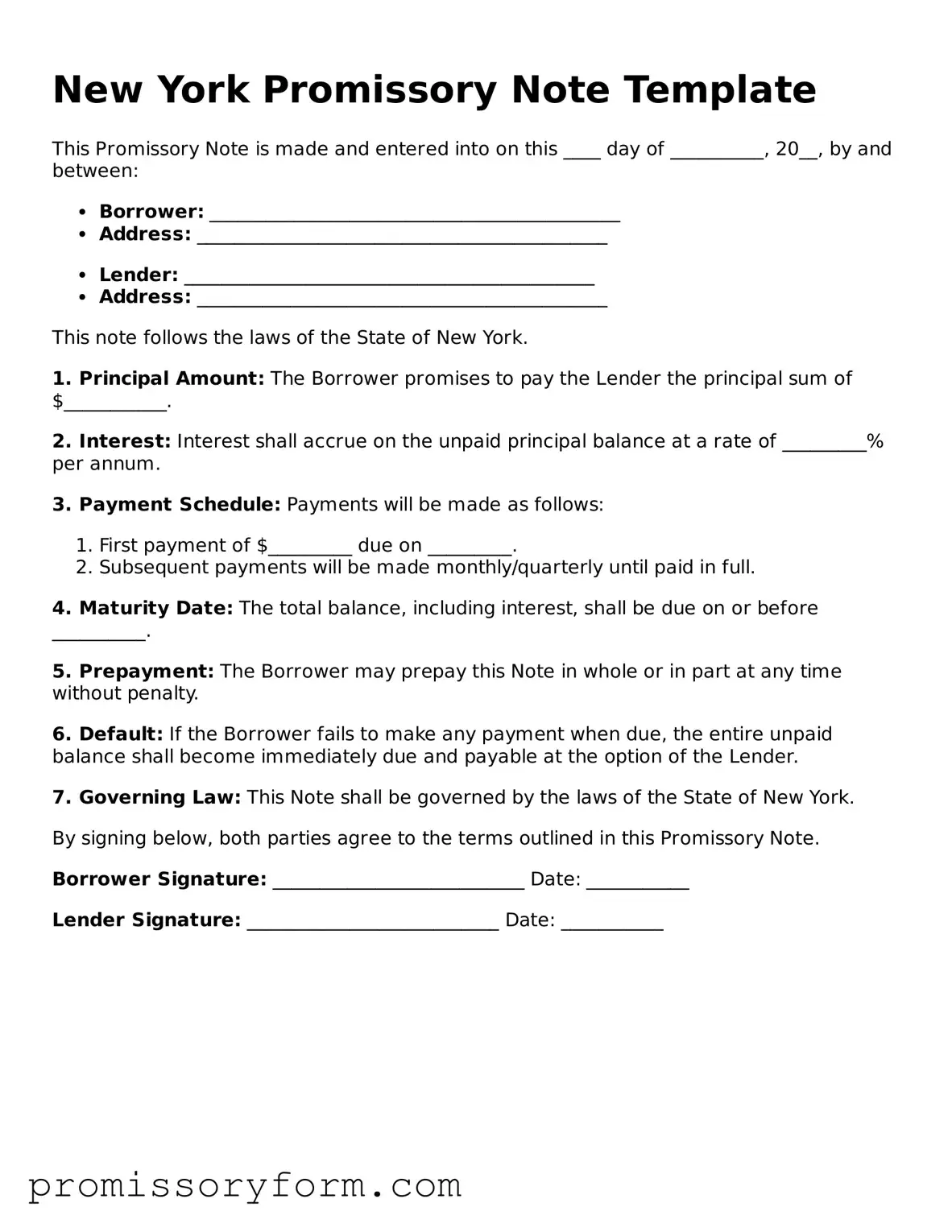

- Complete Information: Ensure that all fields are filled out accurately. This includes the names of the borrower and lender, the loan amount, and the interest rate.

- Clear Terms: Clearly outline the repayment terms. Specify when payments are due, the total duration of the loan, and any late fees that may apply.

- Signatures Required: Both the borrower and lender must sign the document. This signifies that both parties agree to the terms laid out in the note.

- Witness or Notary: Consider having the document witnessed or notarized. This can add an extra layer of security and validation to the agreement.

- Keep Copies: After the document is signed, make sure to keep copies for both parties. This helps in case any disputes arise in the future.

Following these steps can help ensure that the promissory note is valid and enforceable. It’s essential to approach this process with care and attention to detail.