Filling out a New Mexico Promissory Note form can be straightforward, but several common mistakes can lead to complications. Understanding these pitfalls is crucial for ensuring that the document is valid and enforceable. Here are eight mistakes to avoid when completing this important form.

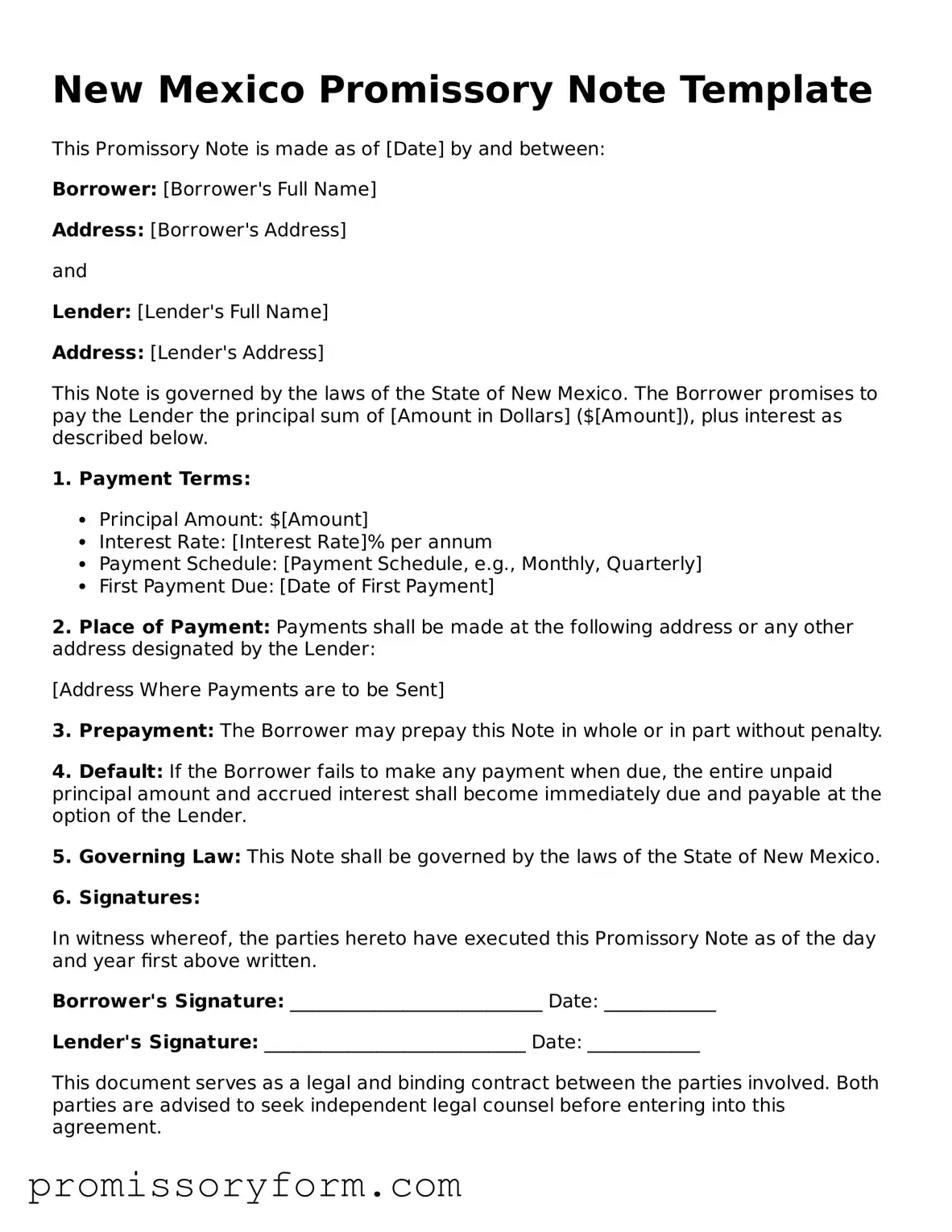

One frequent error is failing to include all necessary parties. The form should clearly identify both the borrower and the lender. Omitting one of the parties can create confusion and legal issues later on. Ensure that full names and contact information are provided for both individuals or entities involved.

Another common mistake is neglecting to specify the loan amount. This figure must be clearly stated in both numerical and written form. If the amount is ambiguous or unclear, it may lead to disputes over how much is actually owed.

People often forget to include the interest rate or leave it blank. The interest rate should be explicitly stated, as it determines how much the borrower will repay over time. If this information is missing, it can result in misunderstandings and potential legal challenges.

Additionally, some individuals do not outline the repayment schedule. A clear timeline for payments is essential. This schedule should detail when payments are due and how much is to be paid at each interval. Without this, it may be difficult to enforce the terms of the loan.

Another mistake is overlooking the consequences of default. The form should include a section that outlines what happens if the borrower fails to make payments. This could involve late fees, acceleration of the loan, or other penalties. Clarifying these terms helps both parties understand their obligations.

People sometimes forget to date the document. A date is critical because it establishes when the agreement takes effect. Without a date, it may be challenging to determine the timeline for repayment and other obligations.

Lastly, failing to have the document properly signed can invalidate the agreement. Both the borrower and lender should sign the Promissory Note in the presence of a witness or notary if required. This step adds an extra layer of protection and authenticity to the document.

By being aware of these common mistakes, individuals can better navigate the process of filling out a New Mexico Promissory Note. Attention to detail is key in creating a clear and enforceable agreement.