Key takeaways

When filling out and using the New Jersey Promissory Note form, there are several important points to keep in mind. Here are four key takeaways:

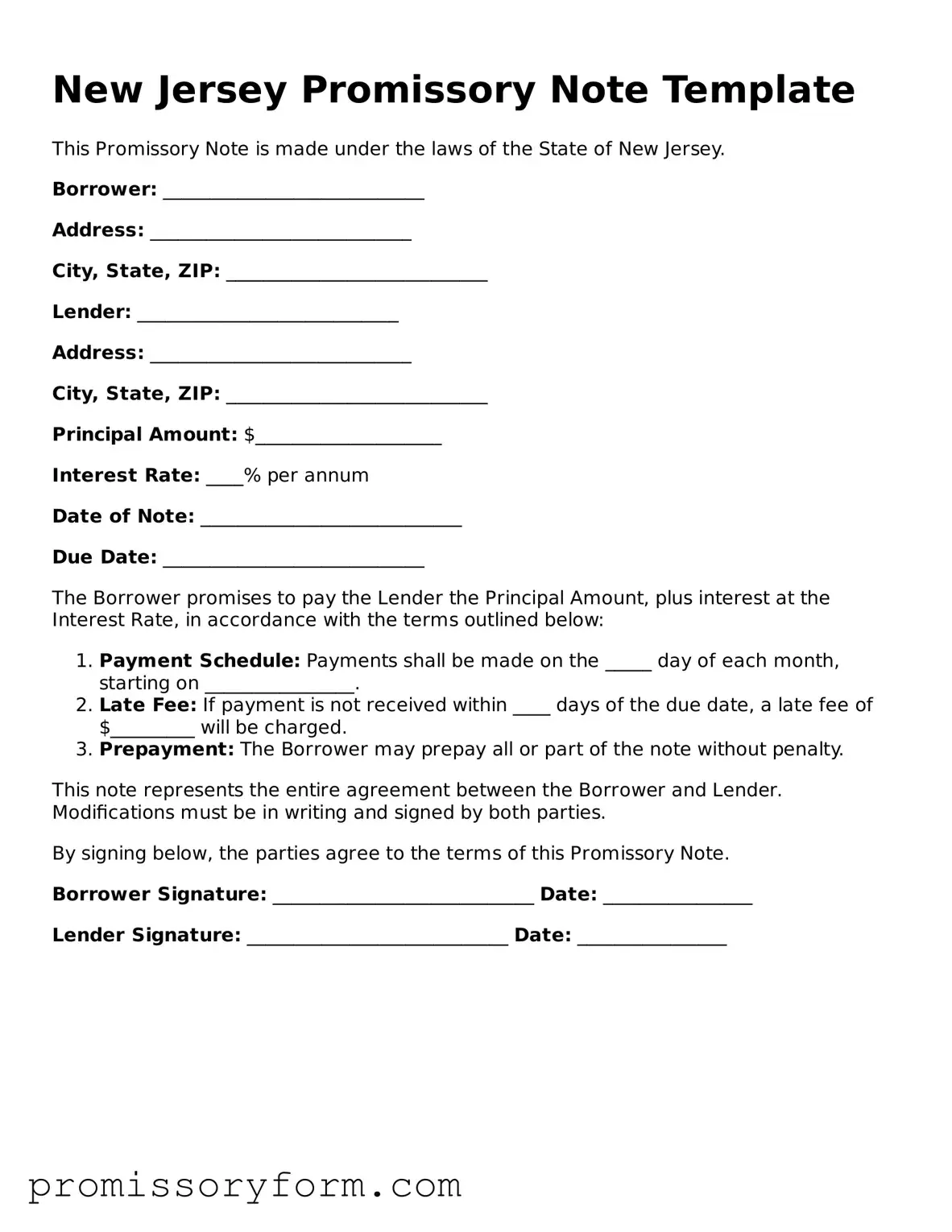

- Clarity is Crucial: Ensure that all terms are clearly stated. This includes the amount borrowed, interest rate, payment schedule, and due date. Ambiguities can lead to misunderstandings later.

- Signatures Matter: Both the borrower and lender must sign the document. This signature validates the agreement and makes it legally binding. Without signatures, the note may not hold up in court.

- Keep Copies: Always make copies of the signed promissory note for both parties. This helps in maintaining a record of the agreement and provides proof of the terms agreed upon.

- Consult Legal Advice: If you have any doubts about the terms or implications of the note, consider seeking legal advice. A professional can help clarify any legal obligations and ensure your interests are protected.