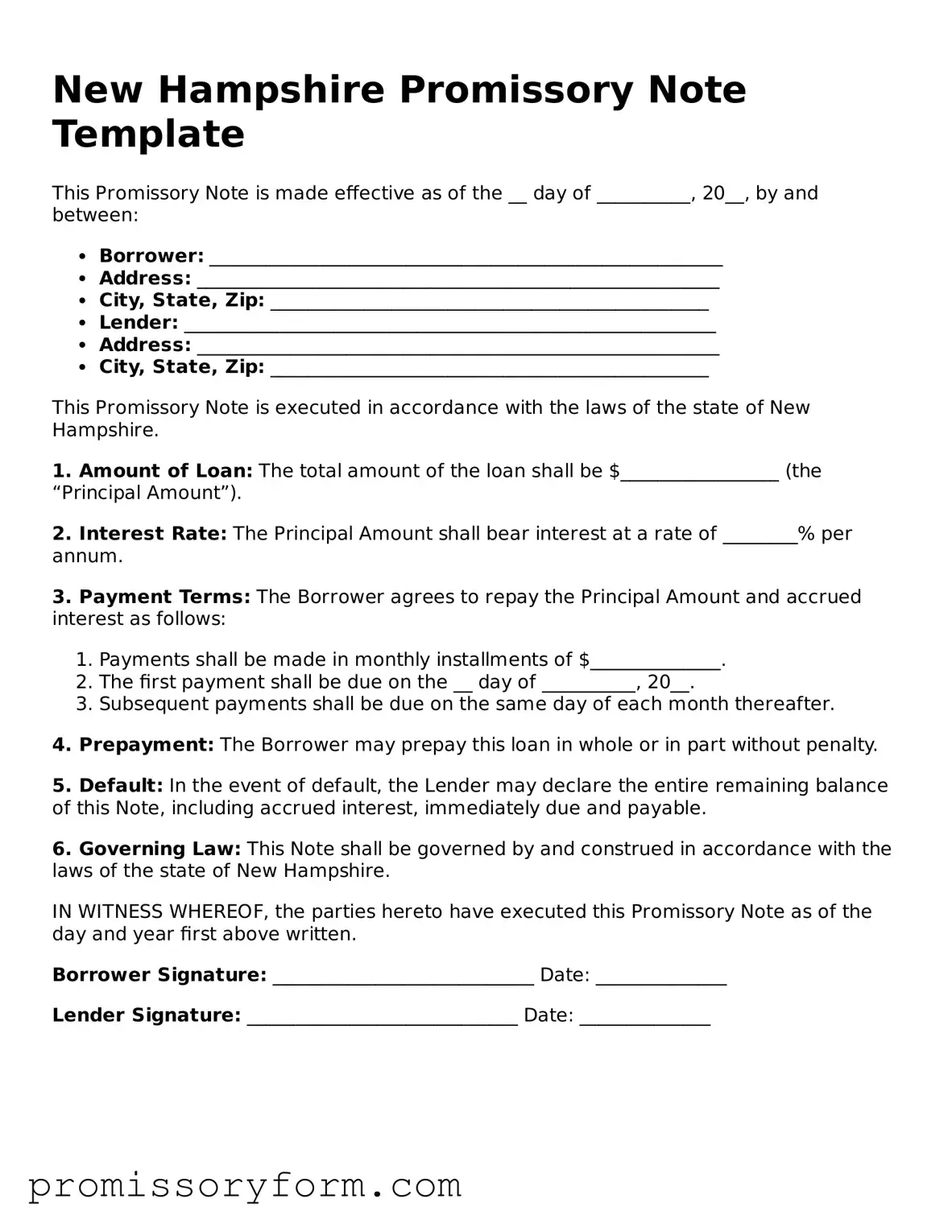

Filling out a New Hampshire Promissory Note form can be straightforward, but many people make common mistakes that can lead to confusion or legal issues. One frequent error is not clearly stating the loan amount. The amount should be written in both numbers and words to avoid any ambiguity. For instance, if the loan is for $5,000, you should write “Five Thousand Dollars” alongside “$5,000.” This ensures clarity and prevents disputes later on.

Another mistake is failing to include the interest rate. If the loan is to accrue interest, it’s essential to specify the rate clearly. Omitting this detail can lead to misunderstandings about how much the borrower will ultimately owe. Additionally, if the interest rate is variable, be sure to explain how it will change over time.

Some individuals neglect to identify the parties involved properly. The borrower and lender must be clearly named, along with their addresses. This identification is crucial, as it establishes who is responsible for repayment and who has the right to collect the debt. Not providing complete information can complicate enforcement of the note.

People also often forget to specify the repayment schedule. Whether the loan is to be repaid in monthly installments, a lump sum, or another arrangement should be clearly outlined. Without a defined schedule, both parties may have different expectations regarding when payments are due.

Another common oversight is not including a late payment penalty. If the borrower fails to make a payment on time, a specified penalty can encourage timely payments and protect the lender’s interests. Not mentioning this can lead to frustration if payments are missed.

In some cases, individuals skip the signature section altogether. Both the borrower and lender must sign the document for it to be legally binding. Without signatures, the note may not hold up in court, leaving the lender without recourse if the borrower defaults.

Additionally, people sometimes overlook the importance of having a witness or notary public present during the signing. While not always required, having a witness can provide an extra layer of protection and verification. This can be particularly helpful if disputes arise later.

Finally, many individuals fail to keep a copy of the completed Promissory Note. It’s vital for both parties to retain a signed copy for their records. This ensures that everyone has access to the agreed-upon terms and can refer back to them if needed. Keeping a copy can save a lot of trouble down the line.