Key takeaways

When it comes to filling out and using the Nebraska Promissory Note form, there are several important points to keep in mind. Here’s a concise list of key takeaways:

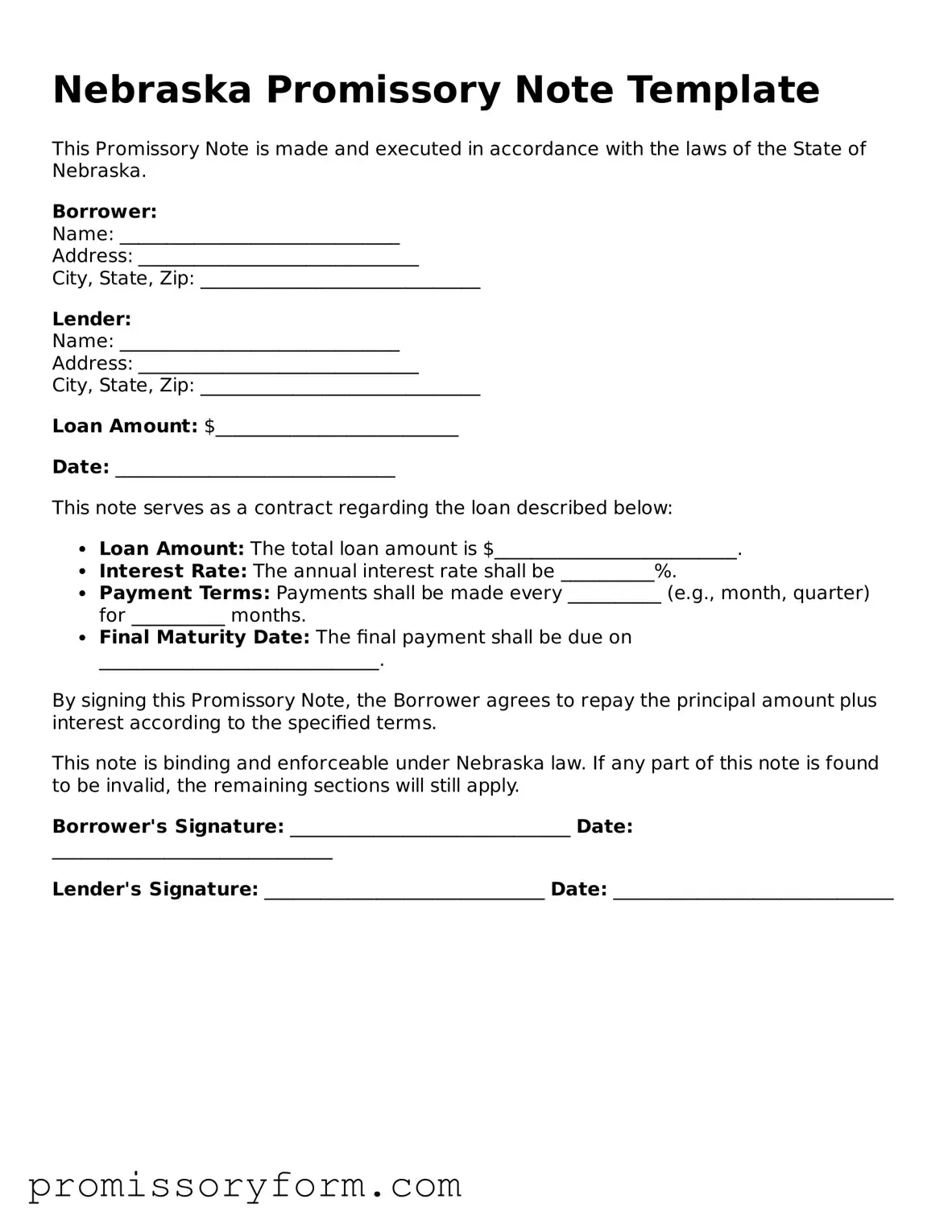

- Ensure all parties involved are clearly identified. This includes the lender and the borrower.

- Specify the loan amount in clear terms. Write the amount in both numbers and words to avoid confusion.

- Detail the interest rate. Make sure it complies with Nebraska state laws to avoid any legal issues.

- Outline the repayment schedule. Include specific dates and amounts for each payment to provide clarity.

- Include any late fees or penalties for missed payments. This helps set expectations for both parties.

- Sign and date the document. Both the borrower and lender should sign to make the agreement legally binding.

- Consider having the document notarized. This adds an extra layer of verification and can be beneficial if disputes arise.

- Keep a copy of the signed note for your records. This is essential for tracking payments and for future reference.