Key takeaways

When filling out and using the Montana Promissory Note form, there are several important considerations to keep in mind. Here are four key takeaways:

-

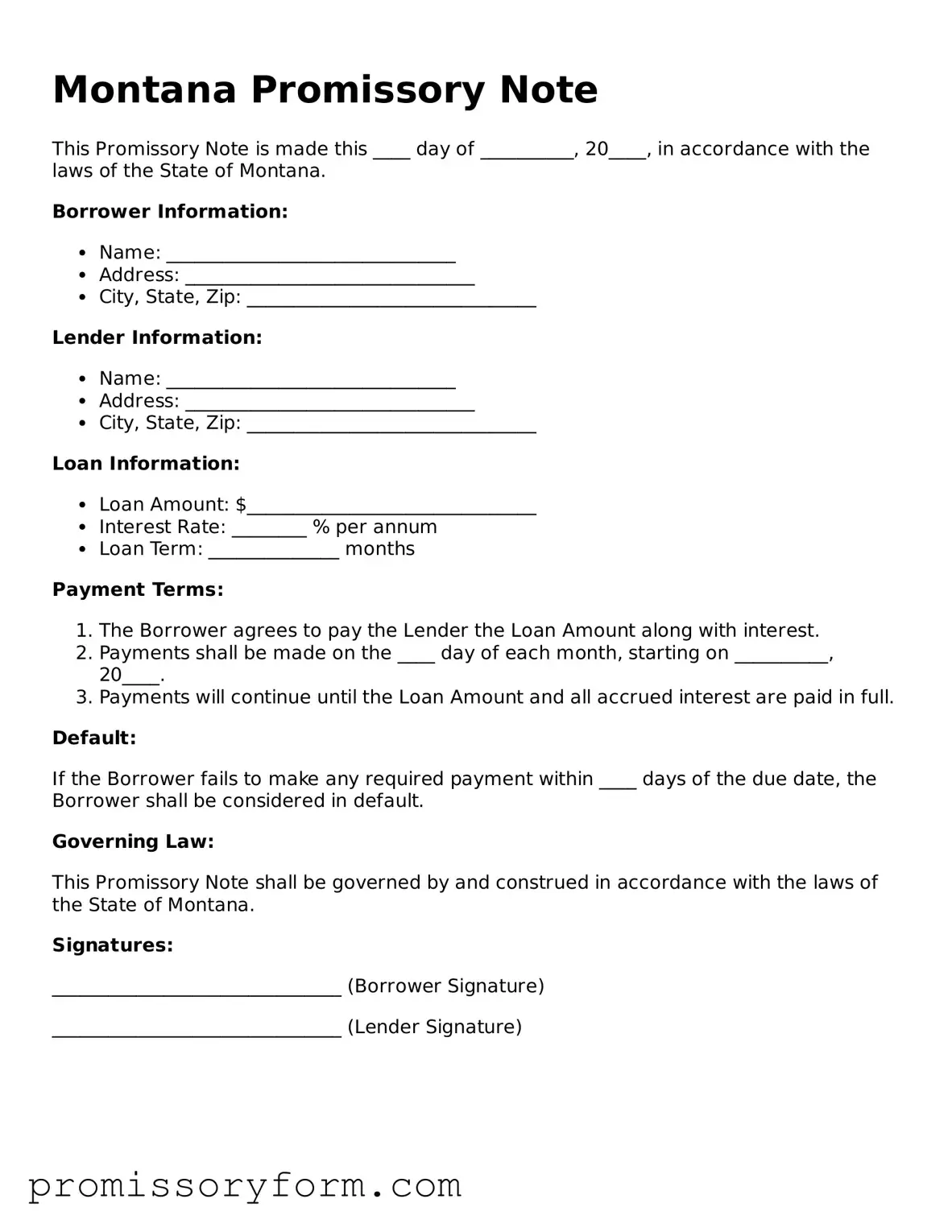

Ensure that all parties involved are clearly identified. This includes the borrower and the lender. Full names and addresses should be provided to avoid any confusion.

-

Specify the loan amount and the terms of repayment. Clearly outline the interest rate, payment schedule, and any late fees that may apply. This clarity helps prevent disputes in the future.

-

Include a section for signatures. Both the borrower and lender must sign the document to make it legally binding. Consider having a witness or notary public present during the signing.

-

Keep a copy of the signed Promissory Note. Both parties should retain a copy for their records. This documentation is crucial if any issues arise regarding the loan.