Common mistakes

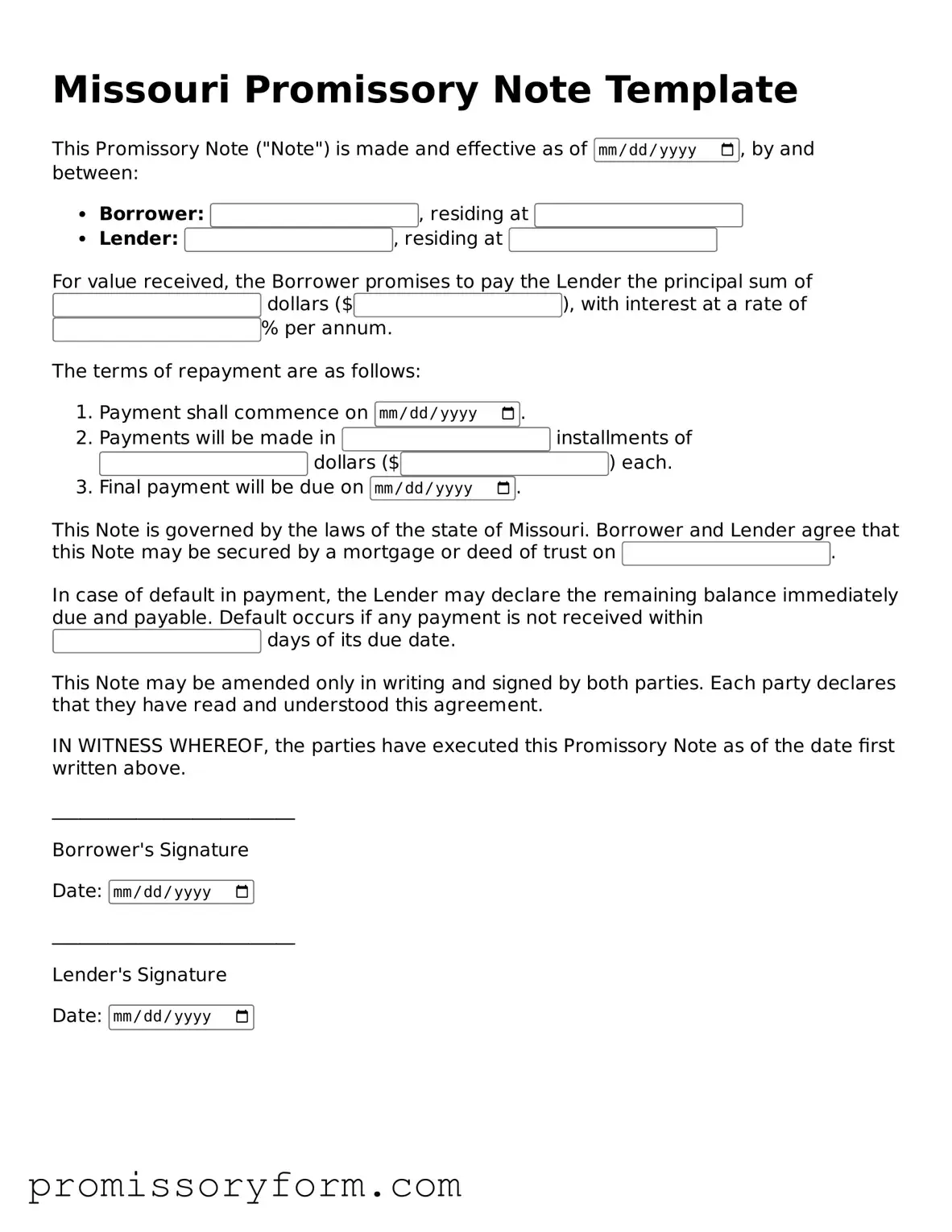

Filling out a Missouri Promissory Note form can be straightforward, but many people make common mistakes that can lead to confusion or legal issues. One frequent error is failing to include all necessary parties. Both the borrower and the lender must be clearly identified, including their full names and addresses. Omitting this information can create ambiguity regarding who is responsible for repayment.

Another common mistake is neglecting to specify the loan amount. It is essential to write the amount in both numerical and written form. This dual representation helps prevent disputes about the loan's value. If only one format is used, it may lead to misunderstandings down the line.

People often overlook the importance of detailing the interest rate. If the interest rate is not clearly stated, it can result in confusion about how much the borrower owes over time. Additionally, ensure that the interest rate complies with Missouri's usury laws to avoid legal complications.

Not including a repayment schedule is another mistake. Clearly outlining when payments are due and the total duration of the loan helps both parties understand their obligations. A vague repayment plan can lead to missed payments and financial strain.

Some individuals forget to sign the document. A Promissory Note is not legally binding without the signatures of both the borrower and the lender. Ensure that all parties sign and date the form to validate the agreement.

Another error involves failing to keep copies of the signed document. Both parties should retain a copy for their records. This practice is crucial for future reference and can be invaluable in case of disputes.

People sometimes use vague language when describing the purpose of the loan. Clearly stating the purpose helps clarify the intent of the agreement and can prevent misunderstandings. Specificity is key.

Ignoring the option for witnesses or notarization can also be a mistake. While not always required, having a witness or notarizing the document adds an extra layer of legitimacy. This can be beneficial if any disputes arise in the future.

Finally, failing to review the completed form thoroughly is a common oversight. Before submitting or signing the Promissory Note, take the time to double-check all entries for accuracy. Small errors can lead to significant issues later on.