Key takeaways

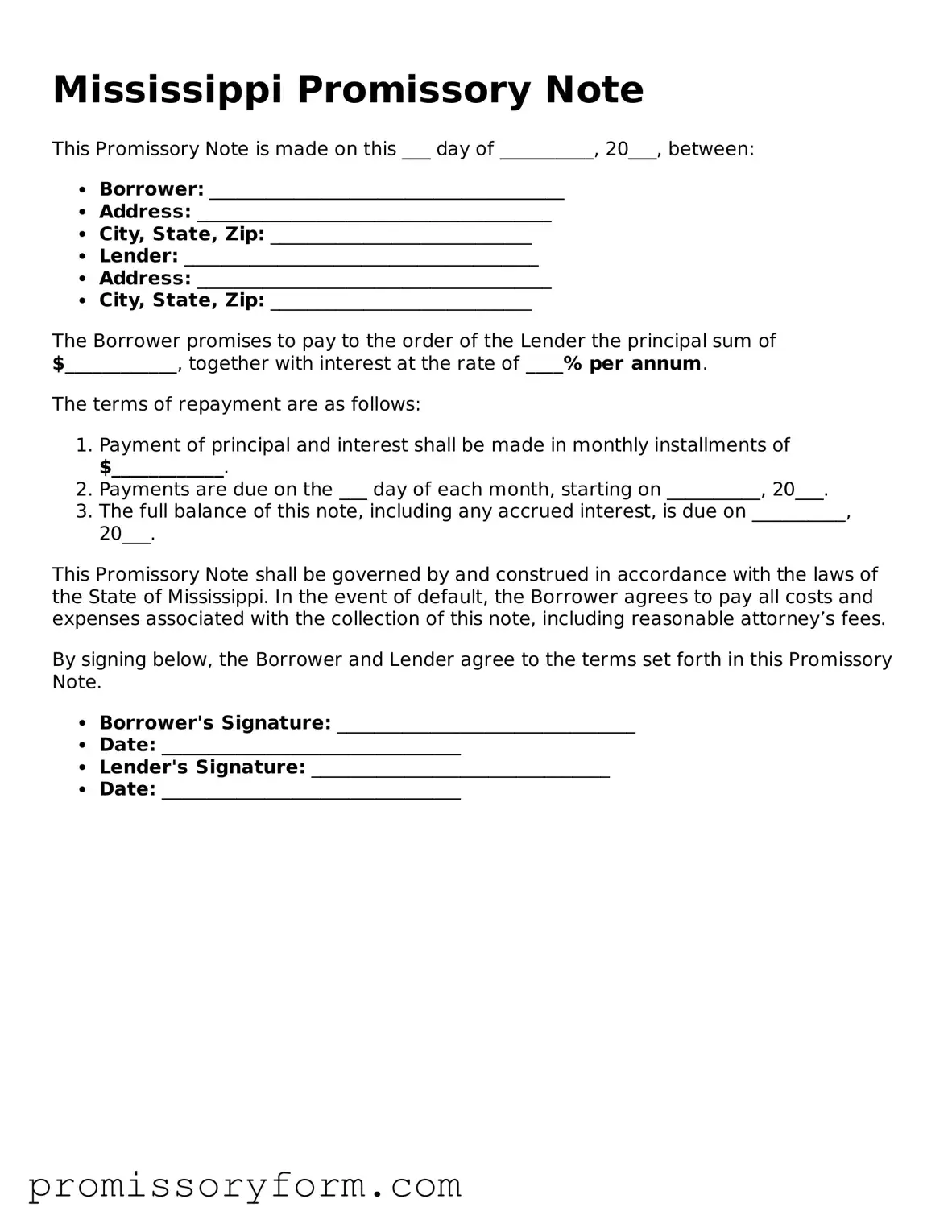

When filling out and using the Mississippi Promissory Note form, it is essential to keep several key points in mind. This document serves as a written promise to repay a loan and is legally binding. Understanding its components will help ensure that both parties are protected.

- Understand the Parties Involved: Clearly identify the borrower and the lender. This includes providing full names and addresses to avoid any confusion.

- Specify the Loan Amount: Clearly state the total amount being borrowed. Precision is crucial to avoid disputes later on.

- Detail the Interest Rate: Include the interest rate, if applicable. This should be stated as an annual percentage rate (APR) to clarify the cost of borrowing.

- Outline the Repayment Terms: Clearly define how and when the borrower will repay the loan. This includes the payment schedule, due dates, and any grace periods.

- Include Default Provisions: Specify what happens in the event of a default. This can include late fees, acceleration of payment, or other consequences.

- Signatures Are Essential: Both parties must sign and date the document. This signifies that all terms have been agreed upon and that the note is enforceable.

By following these guidelines, individuals can effectively use the Mississippi Promissory Note form to facilitate a loan agreement while protecting their interests.