Filling out a Minnesota Promissory Note form can seem straightforward, but many individuals encounter pitfalls that can lead to complications down the line. Understanding these common mistakes can help ensure that the document serves its intended purpose without any hitches.

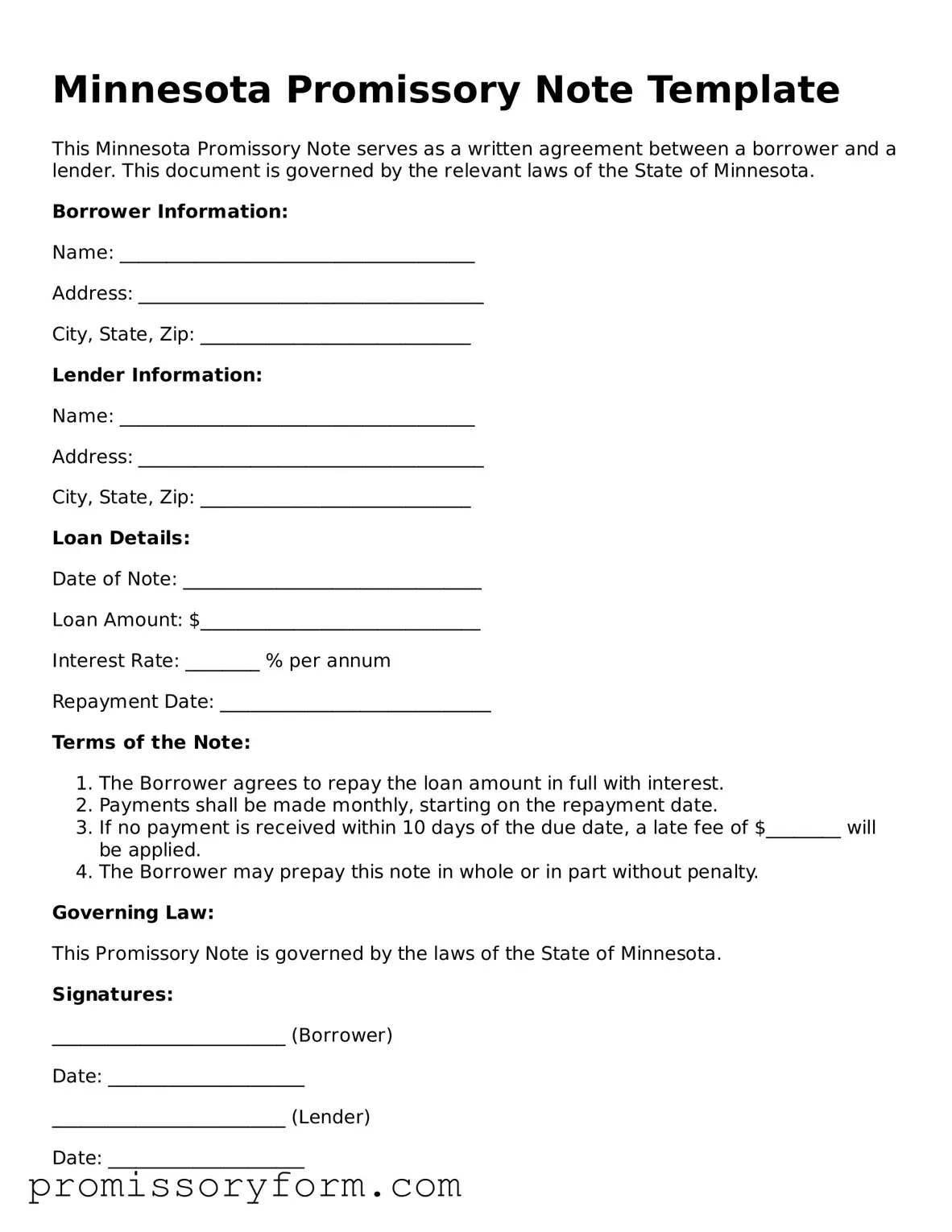

One frequent error is failing to include all required information. A Promissory Note must clearly state the names of the borrower and lender, the amount borrowed, and the interest rate, among other details. Omitting even one piece of critical information can render the document incomplete and potentially unenforceable.

Another mistake often made is using vague language. It’s essential to be specific about the terms of repayment. For example, stating "monthly payments" without specifying the amount or due dates can lead to confusion. Clear, precise language helps prevent misunderstandings and disputes.

Many people also overlook the importance of signing the document. A Promissory Note is not valid unless it is signed by the borrower, and in some cases, the lender may also need to sign. Without these signatures, the note lacks the necessary legal weight.

Additionally, individuals sometimes forget to date the Promissory Note. The date serves as a reference point for the terms of the agreement and can affect the timeline for repayment. A missing date may complicate matters if the agreement is ever disputed.

Another common oversight is neglecting to consider the consequences of default. The document should outline what happens if the borrower fails to make payments. This can include late fees, acceleration of the debt, or other penalties. Clearly defining these terms can protect the lender’s interests.

Some borrowers may mistakenly believe that a verbal agreement suffices. However, a Promissory Note is a formal document intended to provide evidence of the loan agreement. Relying solely on verbal commitments can lead to misunderstandings and challenges in enforcing the agreement.

People often miscalculate the interest rate or how it will be applied. The form should clearly specify whether the interest is simple or compound, and how often it is calculated. Misunderstandings regarding interest can lead to disputes over the total amount owed.

Another issue arises when individuals use outdated or incorrect versions of the form. It is crucial to ensure that the most current version of the Minnesota Promissory Note is being used. Using an outdated form can lead to legal complications or misunderstandings about the terms.

Lastly, failing to keep copies of the signed Promissory Note can create problems. Both the borrower and lender should retain a copy for their records. This ensures that both parties have access to the same information and can refer back to the terms of the agreement if needed.