Key takeaways

When filling out and using the Michigan Promissory Note form, there are several important points to keep in mind. Here are key takeaways that will help you navigate the process effectively:

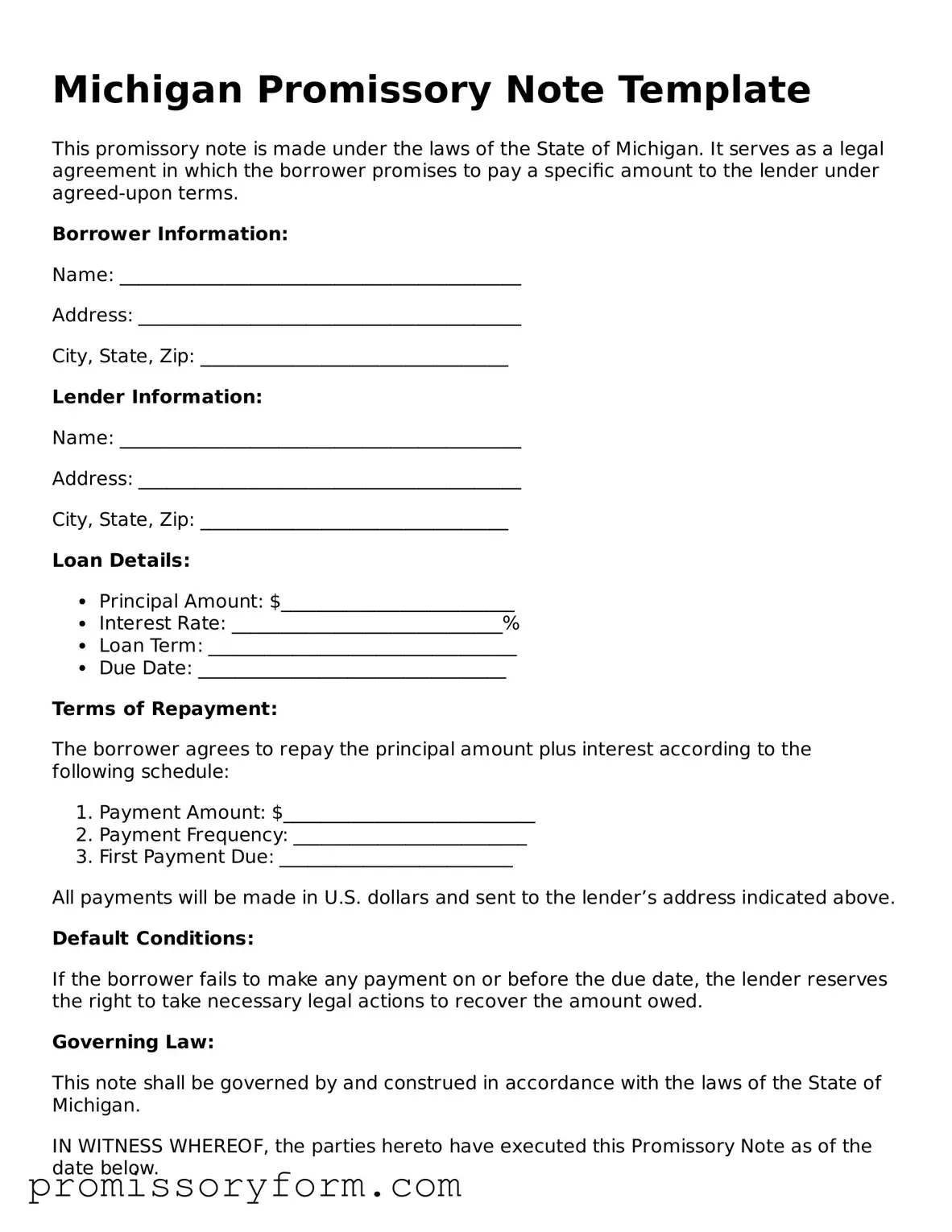

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan to the lender. It serves as a record of the loan agreement.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that both parties are easily identifiable.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure is crucial for both parties to understand their financial obligations.

- Include Interest Rates: If applicable, include the interest rate that will be charged on the loan. This should be clearly stated to avoid confusion later.

- Outline Payment Terms: Detail the repayment schedule, including due dates and the amount of each payment. This helps both parties keep track of the loan's progress.

- Consider Legal Requirements: Ensure that the document complies with Michigan laws regarding promissory notes. This may include specific language or formatting.

- Keep Copies: After completing the form, both the borrower and lender should keep signed copies for their records. This is important for future reference and accountability.

By following these guidelines, you can create a clear and effective promissory note that protects the interests of both parties involved in the loan agreement.