Key takeaways

When considering the Massachusetts Promissory Note form, it’s important to understand its key components and implications. Here are some essential takeaways to keep in mind:

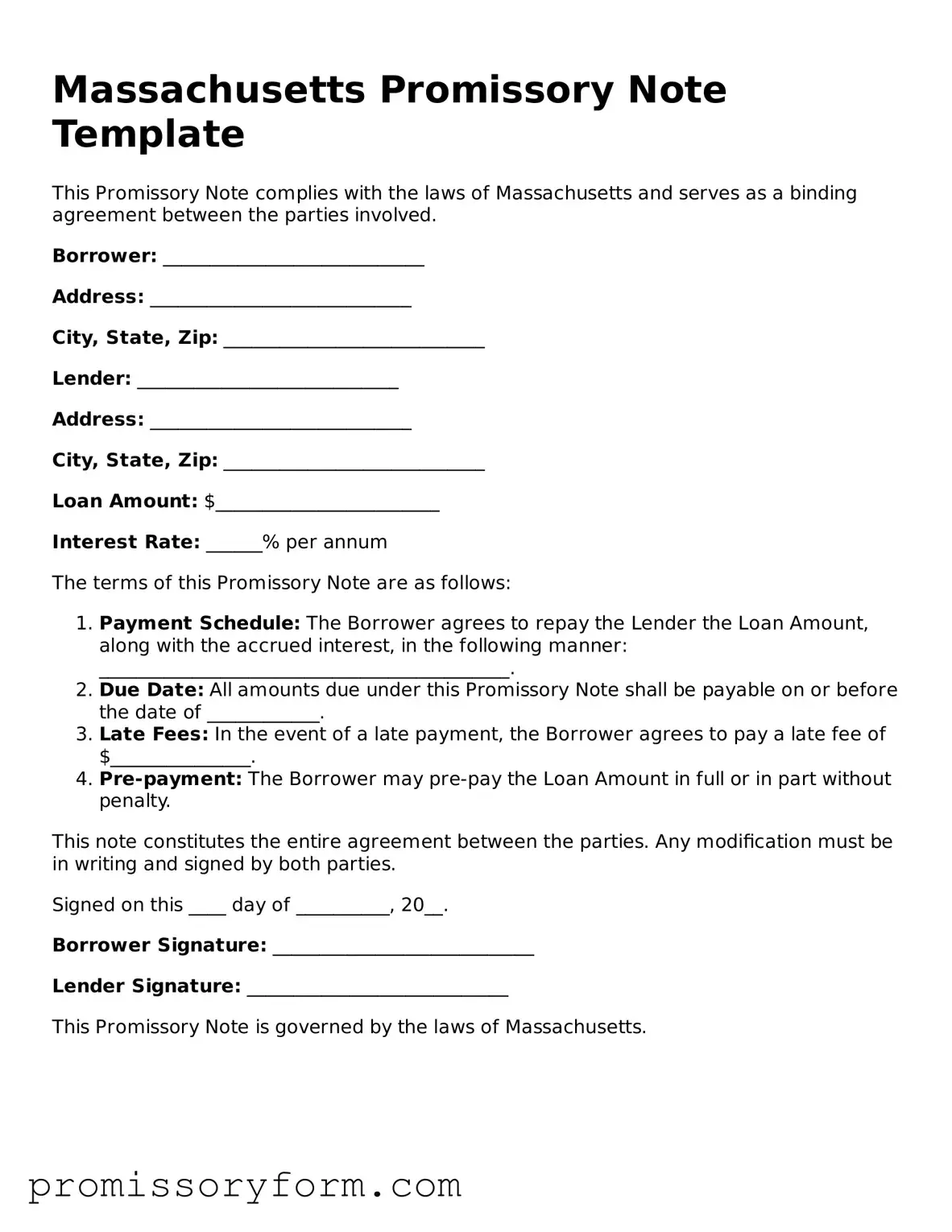

- Clear Identification: Always ensure that both the borrower and lender are clearly identified. This includes full names and addresses to avoid confusion later.

- Loan Amount: Specify the exact amount being borrowed. This figure should be written both numerically and in words to prevent any misunderstandings.

- Interest Rate: If applicable, include the interest rate. Make sure to clarify whether it is fixed or variable, as this affects repayment amounts.

- Repayment Terms: Outline the repayment schedule clearly. Include due dates and the frequency of payments, whether monthly, quarterly, or otherwise.

- Default Clauses: Address what happens in case of default. This section can detail penalties or actions that may be taken if payments are missed.

- Signatures: Ensure that both parties sign and date the document. This step is crucial for the note to be legally binding.

Understanding these key aspects can help both borrowers and lenders navigate their financial agreements more effectively. A well-completed Promissory Note can provide clarity and security for both parties involved.