Common mistakes

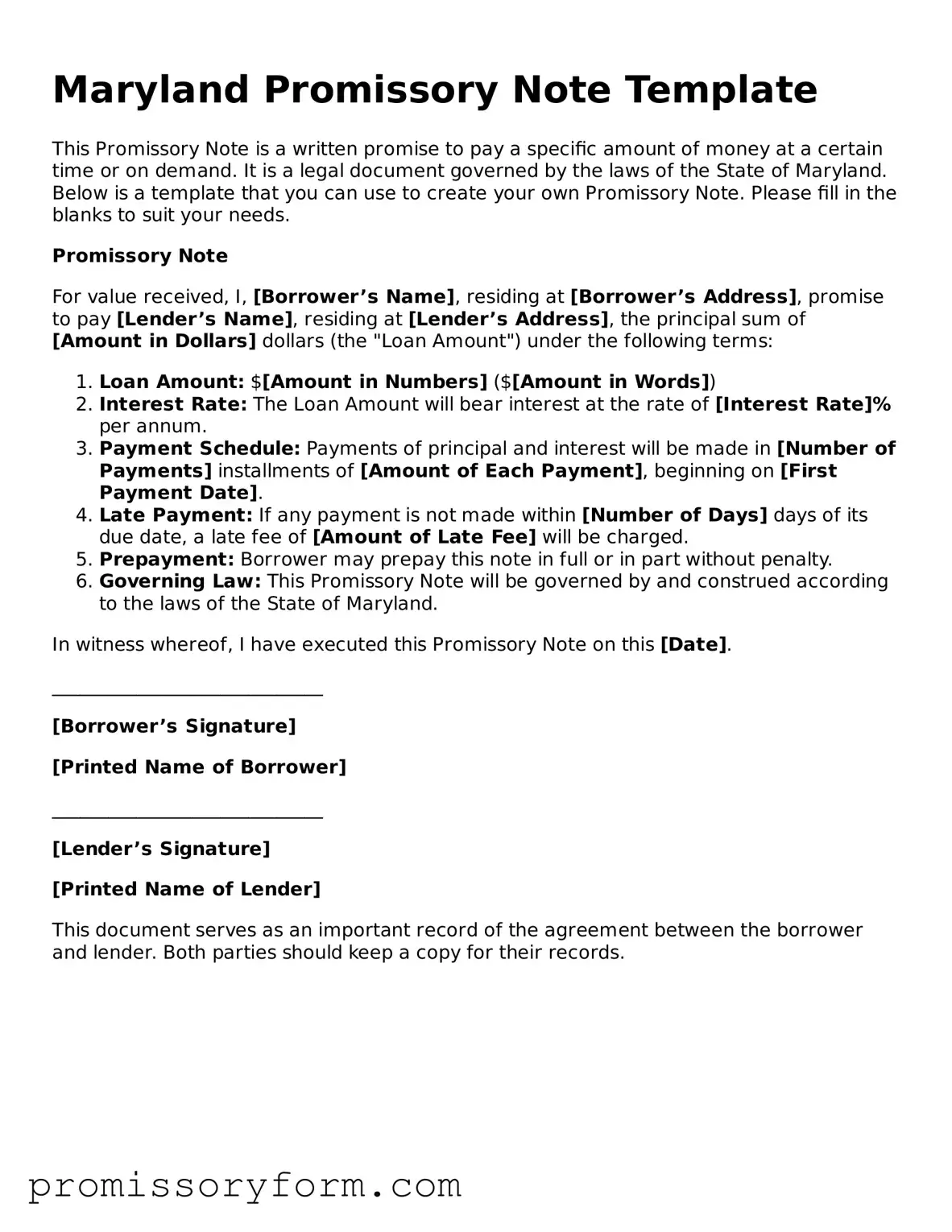

Filling out a Maryland Promissory Note form can be straightforward, but several common mistakes can lead to complications. One significant error is failing to include all necessary details. The borrower’s name, address, and the loan amount must be clearly stated. Omitting any of these critical pieces of information can result in confusion or disputes later on.

Another frequent mistake is not specifying the interest rate. This detail is crucial as it outlines the cost of borrowing. If the interest rate is left blank or is unclear, it may lead to misunderstandings between the lender and borrower. Both parties should agree on a specific rate to avoid potential conflicts.

Additionally, many individuals neglect to outline the repayment schedule. This schedule should detail when payments are due and how much is to be paid at each interval. Without a clear repayment plan, borrowers may struggle to meet their obligations, and lenders may find it difficult to enforce the terms of the note.

Some people also forget to include a default clause. This clause outlines what happens if the borrower fails to make payments. Without this provision, the lender may face challenges in recovering the loan amount, should the borrower default.

Another common oversight is not having the document properly signed and dated. Both the borrower and lender must sign the Promissory Note for it to be legally binding. Failing to do so can render the document unenforceable, leaving both parties without legal recourse.

Finally, individuals often overlook the importance of keeping a copy of the signed note. After the document is completed, both parties should retain a copy for their records. This ensures that both the lender and borrower have access to the terms of the agreement, which can be crucial in case of future disputes.