Common mistakes

When filling out the Maine Promissory Note form, many individuals make common mistakes that can lead to confusion or even legal issues down the line. Understanding these pitfalls can help ensure that the document is completed correctly and serves its intended purpose.

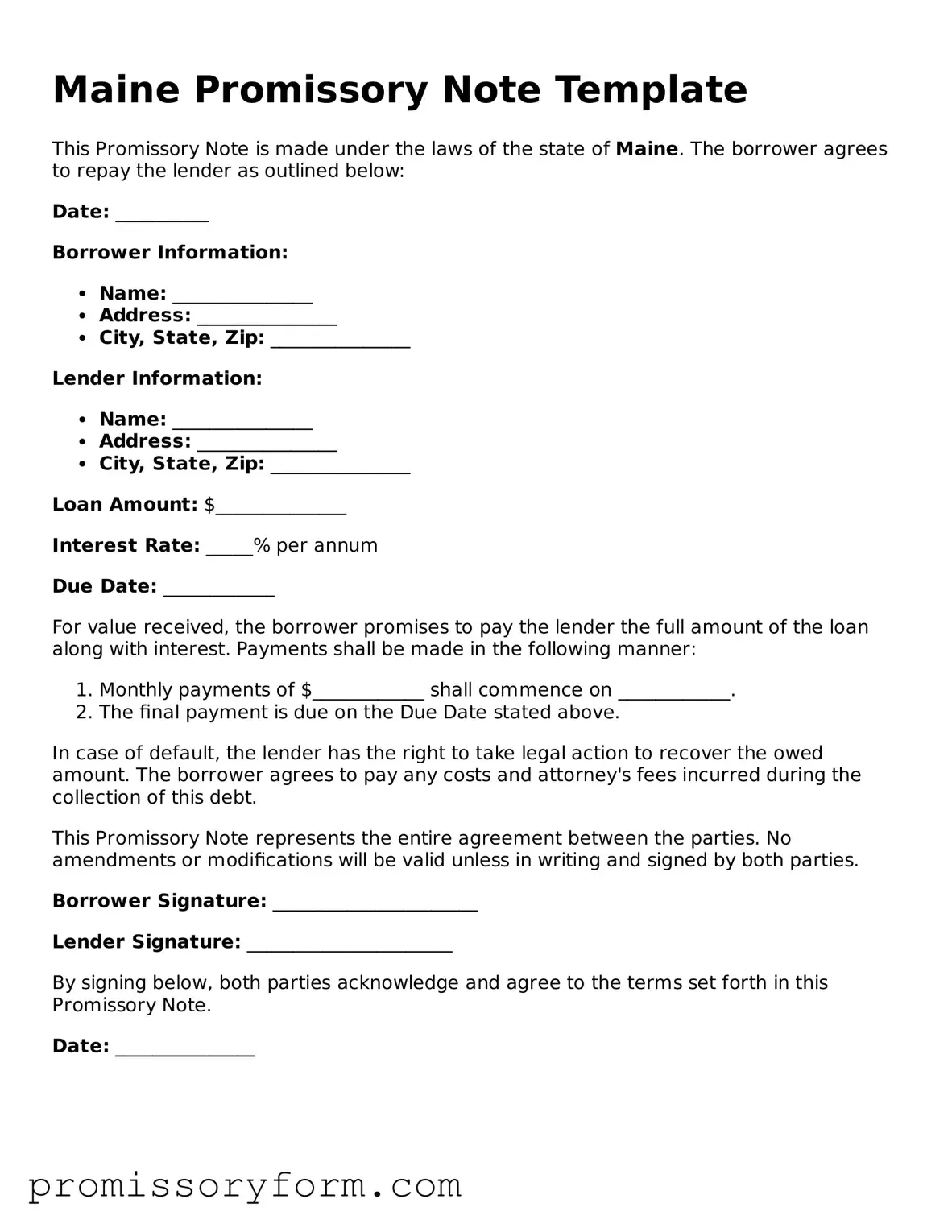

One frequent error is failing to include all necessary parties involved in the agreement. A promissory note should clearly identify the borrower and the lender. Omitting one of these parties can create ambiguity regarding who is responsible for repayment. It’s essential to provide full names and addresses to avoid any potential disputes later.

Another mistake often made is neglecting to specify the loan amount. While it may seem obvious, clearly stating the exact amount being borrowed is crucial. This detail helps prevent misunderstandings and establishes a clear expectation for repayment. Without it, the note may lack enforceability.

People also sometimes overlook the importance of detailing the repayment terms. This includes specifying the payment schedule, interest rate, and any penalties for late payments. Vague terms can lead to disagreements, so clarity in these areas is vital. Both parties should know when payments are due and what happens if they are late.

Additionally, failing to sign and date the document is a common oversight. A promissory note is not legally binding unless it is signed by both the borrower and the lender. The date is also important as it establishes when the agreement takes effect. Without these signatures, the note may not hold up in court.

Lastly, individuals sometimes forget to keep copies of the completed note. After signing, both parties should retain a copy for their records. This is important for future reference and can serve as proof of the agreement if any disputes arise. Keeping a record ensures that both parties are aware of their obligations and the terms agreed upon.