Key takeaways

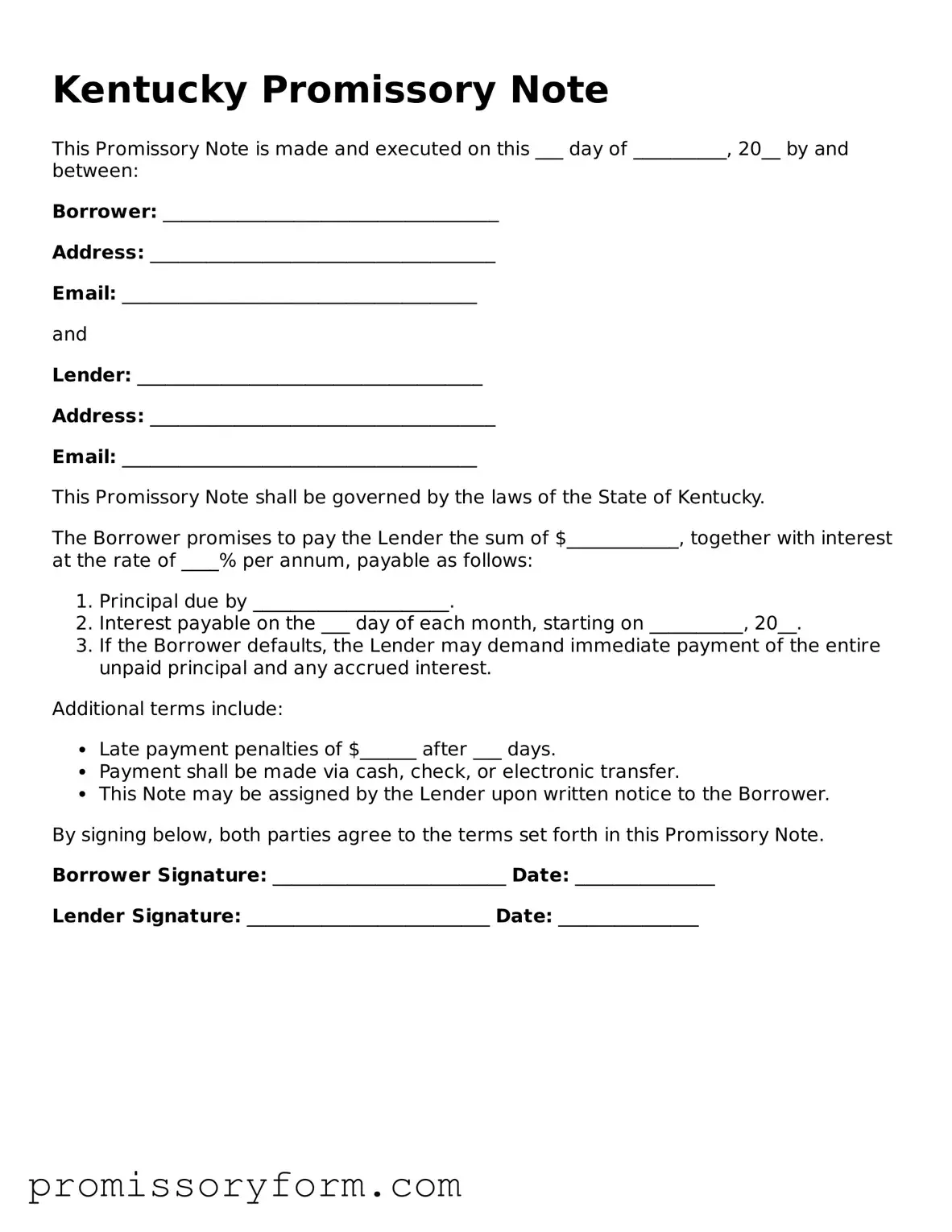

The Kentucky Promissory Note form serves as a written promise to pay a specified amount of money to a lender.

Both the borrower and lender must clearly identify themselves in the document, including full names and addresses.

It is important to specify the loan amount, interest rate, and payment terms to avoid misunderstandings.

Signatures from both parties are required to validate the agreement, and these should be dated.

The form should include a clause regarding default, outlining the consequences if the borrower fails to make payments.

Make sure to keep a copy of the completed note for personal records, as this serves as proof of the agreement.

Consider consulting with a legal professional if there are any uncertainties about the terms or implications of the note.