Key takeaways

Filling out and using the Kansas Promissory Note form requires attention to detail and understanding of key components. Below are important takeaways to consider:

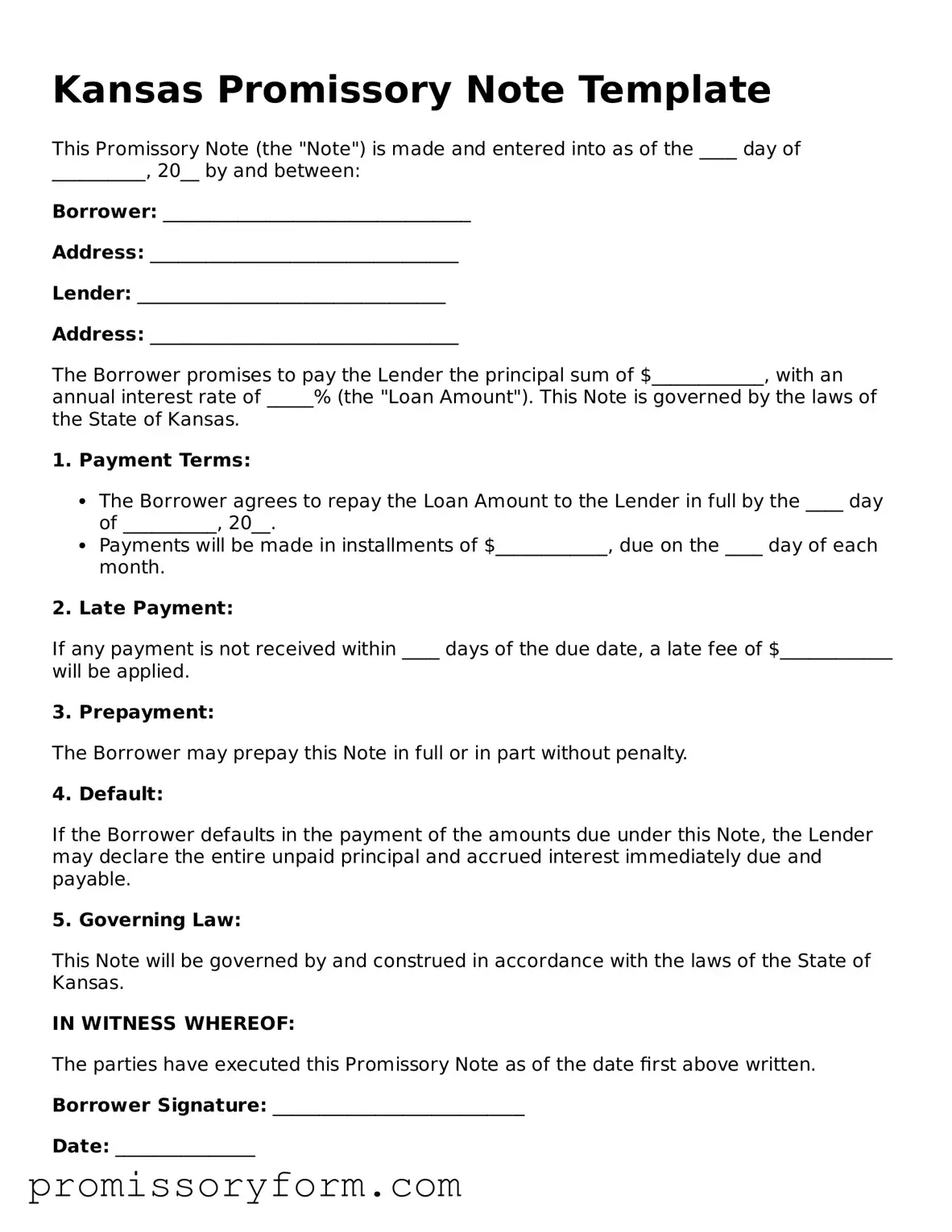

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This establishes who is involved in the agreement.

- Specify the Loan Amount: Indicate the exact amount being borrowed. This ensures clarity on the financial obligation.

- Detail the Interest Rate: Include the interest rate applicable to the loan. This is critical for understanding the total repayment amount.

- Outline the Repayment Terms: Specify the repayment schedule, including due dates and frequency of payments. This helps both parties manage their expectations.

- Include Late Fees: If applicable, outline any late fees for missed payments. This can serve as a deterrent against late payments.

- State the Maturity Date: Clearly indicate when the loan must be fully repaid. This provides a timeline for both parties.

- Signatures Required: Ensure both parties sign the document. Signatures validate the agreement and indicate acceptance of the terms.

- Keep Copies: Each party should retain a copy of the signed promissory note. This serves as a reference for future discussions or disputes.

Understanding these elements can facilitate a smoother transaction and ensure both parties are on the same page regarding the loan agreement.