Key takeaways

When dealing with the Iowa Promissory Note form, understanding its components and implications is crucial. Here are some key takeaways to keep in mind:

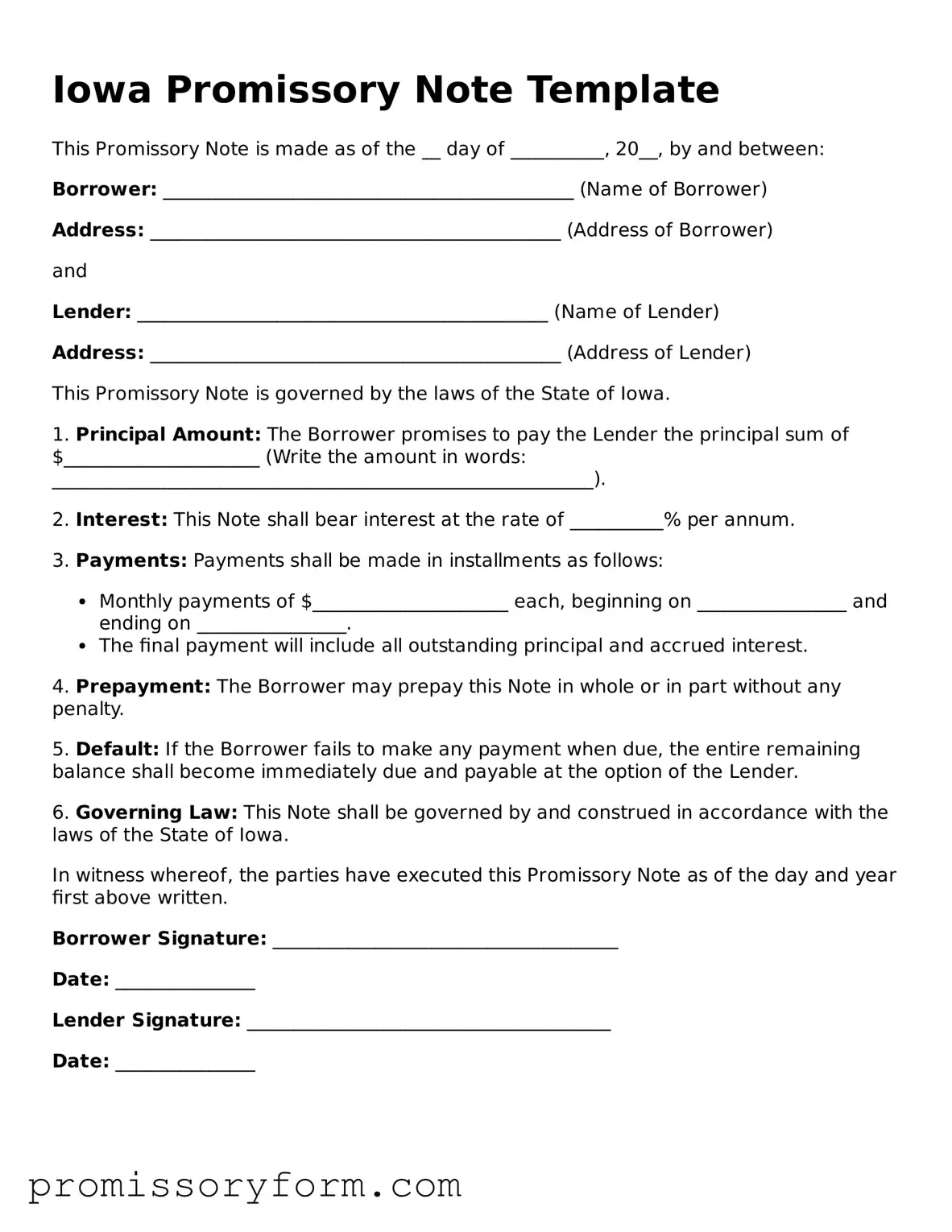

- Clear Identification: Ensure that all parties involved—the borrower and the lender—are clearly identified. This includes full names and addresses to avoid any confusion.

- Loan Amount: Specify the exact amount of money being borrowed. This figure should be precise to prevent any disputes later on.

- Interest Rate: Clearly state the interest rate, if applicable. This should be expressed as an annual percentage rate (APR) to ensure transparency.

- Payment Terms: Outline the repayment schedule, including due dates and the frequency of payments. This helps both parties understand when payments are expected.

- Default Clauses: Include conditions that define what constitutes a default. This can help protect the lender's interests in case the borrower fails to repay.

- Governing Law: Specify that the note is governed by Iowa law. This is important for legal enforcement should any disputes arise.

- Signatures: Both parties must sign and date the document. Without signatures, the note may not be enforceable, so this step is essential.

Understanding these elements can make the process of filling out and using the Iowa Promissory Note form smoother and more effective for everyone involved.