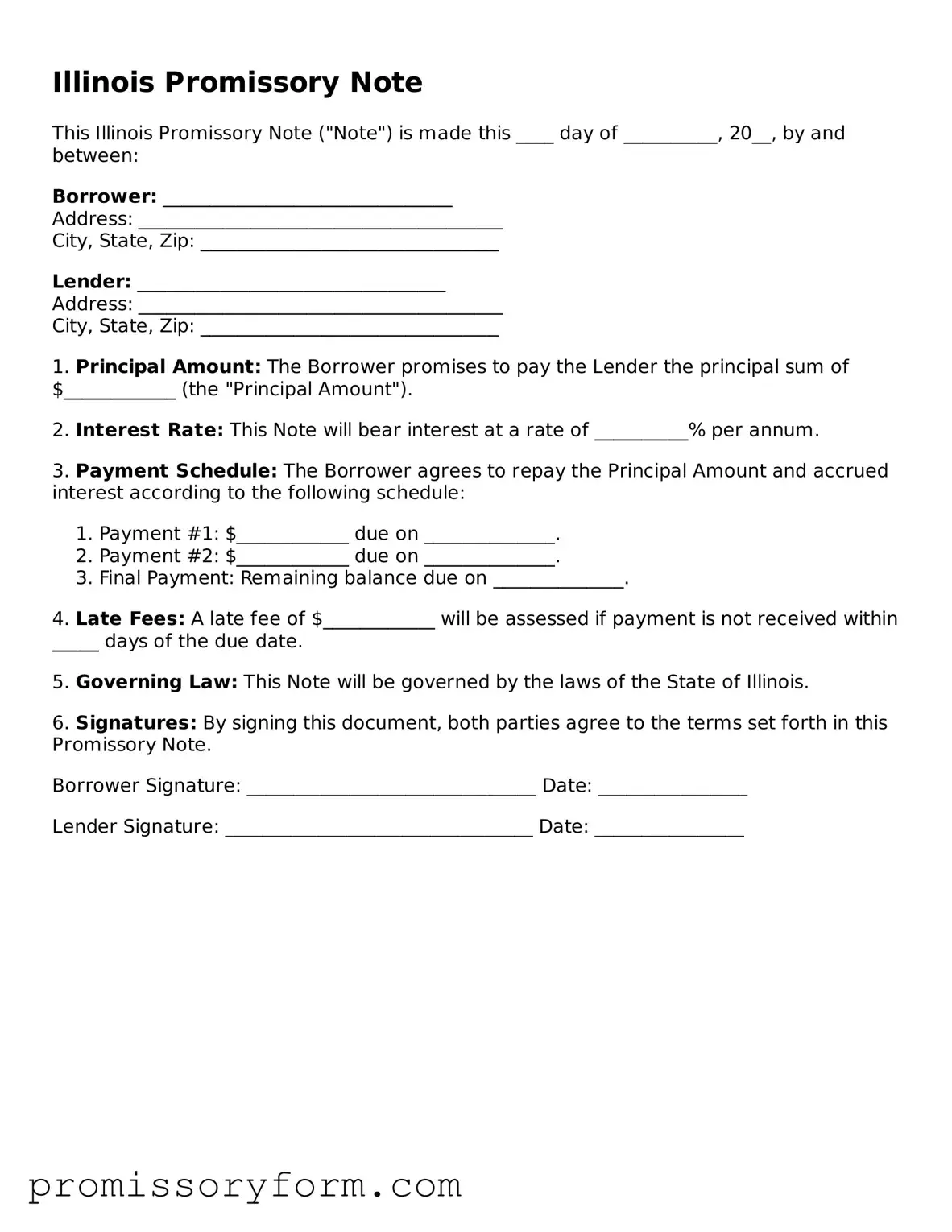

Filling out an Illinois Promissory Note form can seem straightforward, but many individuals make common mistakes that can lead to confusion or even legal issues down the line. One prevalent error is failing to include all necessary details. A complete promissory note should clearly state the amount borrowed, the interest rate, and the repayment schedule. Omitting any of these key components can create ambiguity and lead to disputes.

Another mistake often encountered is not clearly identifying the parties involved. It’s essential to include the full names and addresses of both the borrower and the lender. If this information is incomplete or incorrect, it could complicate the enforcement of the note later on.

Many people also overlook the importance of signatures. A promissory note must be signed by the borrower to be legally binding. Sometimes, individuals forget to sign or mistakenly think that a witness or notary is required when it is not. This oversight can render the document invalid.

In addition, using vague language can be problematic. Terms like “as soon as possible” or “reasonable time” can lead to misunderstandings. It’s better to use precise language that clearly defines the terms of repayment and any penalties for late payments.

People often miscalculate interest rates or fail to specify how interest will be applied. It’s crucial to be clear about whether the interest is simple or compound, and how it will accumulate over time. Misunderstandings in this area can lead to disputes about the total amount owed.

Another frequent error is neglecting to include a default clause. This clause outlines what happens if the borrower fails to make payments. Without it, the lender may have limited options if the borrower defaults, which can complicate recovery efforts.

Some individuals may also forget to date the document. A promissory note should always be dated to establish when the agreement was made. Without a date, it can be challenging to determine the timeline of repayment obligations.

Lastly, people sometimes fail to keep copies of the signed promissory note. It’s essential for both parties to retain a copy for their records. Without it, proving the terms of the agreement can become difficult if a dispute arises.

By being aware of these common mistakes, individuals can take the necessary steps to ensure their Illinois Promissory Note is filled out correctly. This diligence can help avoid potential conflicts and ensure that the agreement is enforceable.