Key takeaways

When filling out and using the Idaho Promissory Note form, it is important to keep several key points in mind. Understanding these can help ensure that the document serves its intended purpose effectively.

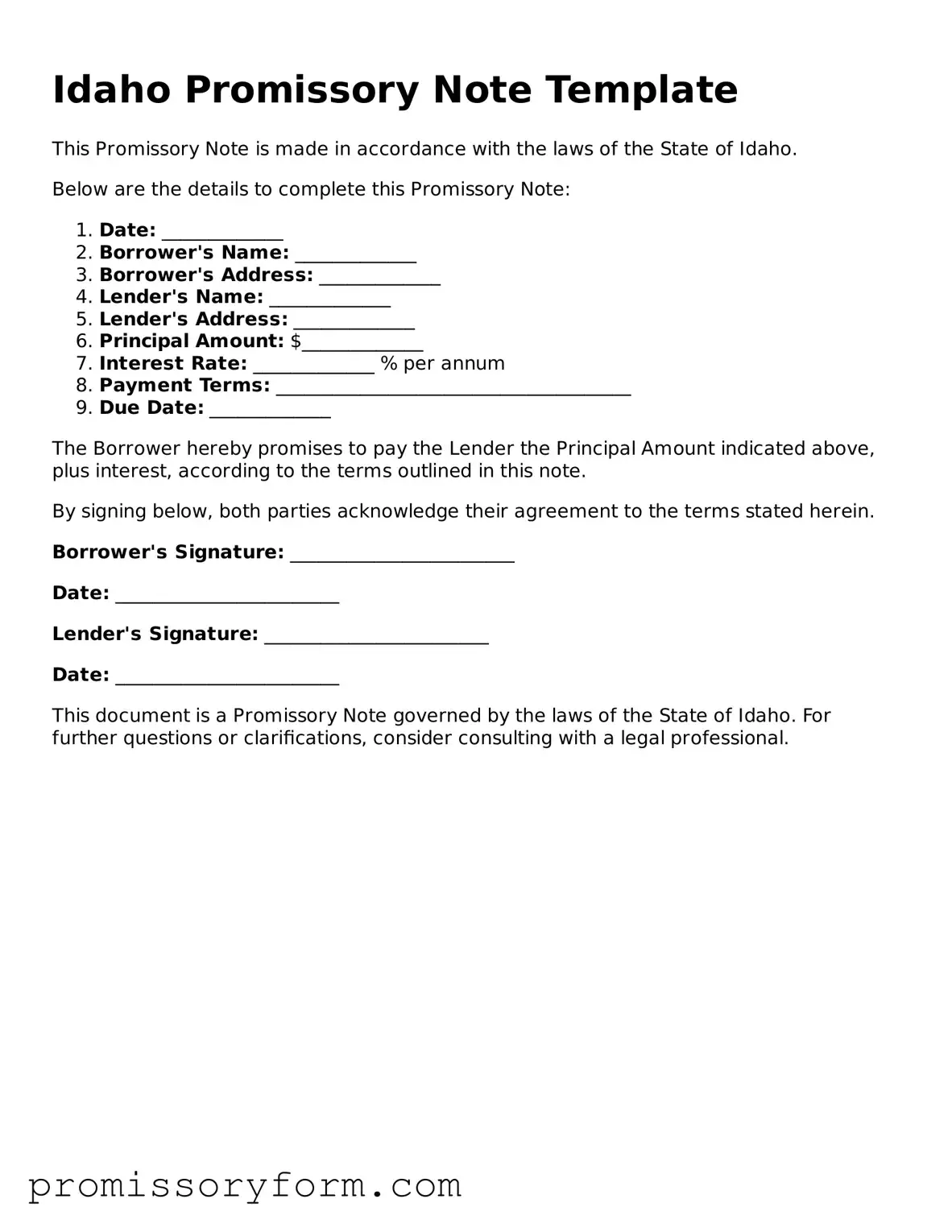

- Identify the parties involved: Clearly state the names and addresses of both the borrower and the lender. This establishes who is responsible for repayment and who is entitled to receive payment.

- Specify the loan amount: Indicate the exact amount being borrowed. This figure should be precise to avoid any ambiguity.

- Detail the interest rate: Include the interest rate being charged on the loan. If applicable, specify whether it is fixed or variable.

- Outline the repayment schedule: Clearly define when payments are due. This may include the frequency of payments, such as monthly or quarterly, and the total duration of the loan.

- Include default terms: Specify what constitutes a default and the consequences that follow. This might include late fees or the acceleration of the loan repayment.

- Signatures are essential: Ensure that both parties sign the document. A signature indicates agreement to the terms outlined in the note.

- Keep a copy: Retain a signed copy of the promissory note for your records. This can be important for future reference or in case of disputes.

By following these guidelines, you can create a clear and effective promissory note that protects the interests of both the borrower and the lender.