Common mistakes

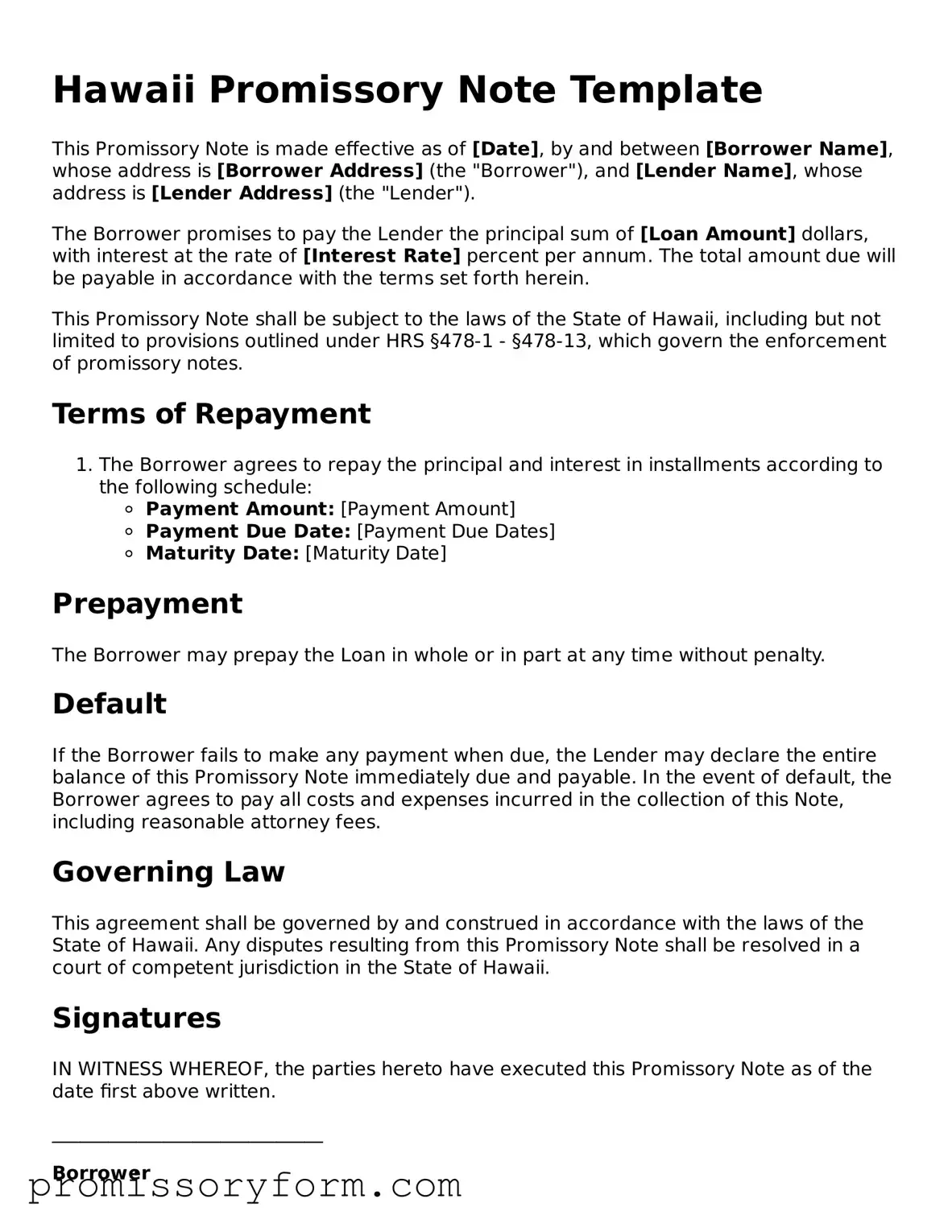

Filling out a Hawaii Promissory Note form can seem straightforward, but many people make common mistakes that can lead to complications later. One frequent error is not including the correct date. It’s essential to date the document accurately, as this marks the beginning of the loan period. An incorrect date can create confusion regarding repayment terms.

Another mistake is failing to clearly identify the parties involved. Both the borrower and lender must be named with their full legal names. Omitting any party or using nicknames can lead to disputes about who is responsible for the loan. Make sure to double-check the names against official documents.

People often overlook the importance of specifying the loan amount. Writing an ambiguous figure or neglecting to state the amount can result in misunderstandings. Clearly indicate the total amount being borrowed, and ensure it matches what both parties have agreed upon.

Interest rates can also be a point of confusion. Some individuals forget to include the interest rate or mistakenly write it in an unclear manner. This can lead to disputes over how much is owed over time. Always state the interest rate explicitly and ensure it complies with Hawaii’s regulations.

Another common error is not outlining the repayment schedule. It’s vital to specify when payments are due and how they should be made. Without a clear repayment plan, borrowers may miss payments, leading to potential legal issues.

Many people fail to include any late fees or penalties for missed payments. If you don’t outline these terms, you may not have a way to enforce consequences for late payments. Clearly define any fees to avoid future misunderstandings.

Some individuals forget to have the document signed by both parties. A Promissory Note is not legally binding without signatures. Ensure that both the borrower and lender sign the form, and consider having it notarized for added protection.

Not keeping a copy of the signed Promissory Note is another mistake. Always retain a copy for your records. This document serves as proof of the agreement and can be crucial if any disputes arise.

Lastly, people sometimes neglect to review the entire document before signing. It’s important to read through the Promissory Note carefully. Take the time to ensure that all terms are correct and understood by both parties. A thorough review can prevent many issues down the line.