Key takeaways

When dealing with a Florida Promissory Note, understanding the essential elements can make the process smoother. Here are some key takeaways:

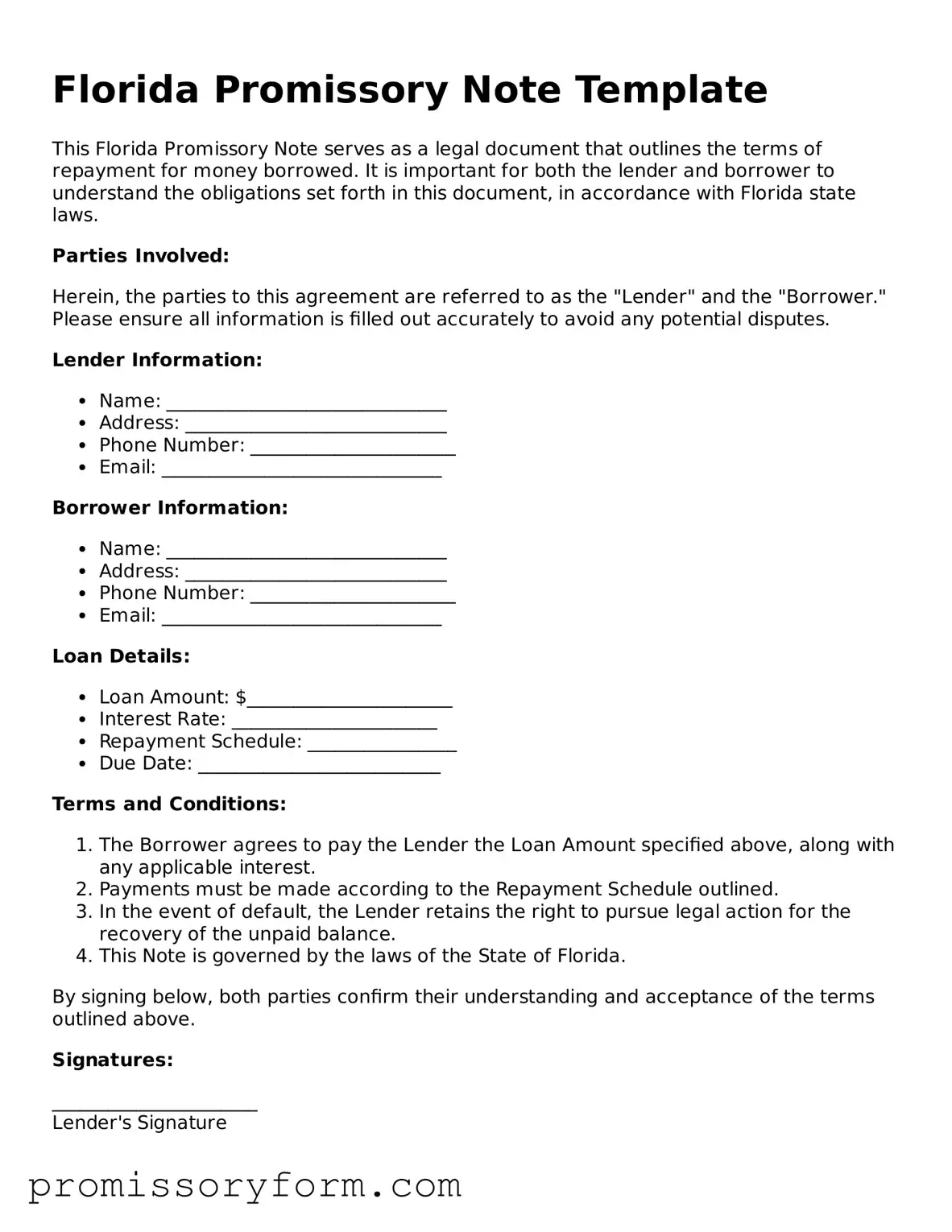

- Clear Identification: Clearly identify the borrower and lender. Use full names and addresses to avoid confusion.

- Loan Amount: Specify the exact amount being borrowed. This figure should be accurate and clearly stated.

- Interest Rate: Indicate the interest rate, if applicable. Make sure it complies with Florida’s usury laws.

- Payment Terms: Outline the repayment schedule. Specify due dates and the frequency of payments, whether monthly, quarterly, or annually.

- Late Fees: Include any penalties for late payments. This helps set expectations for both parties.

- Default Conditions: Clearly define what constitutes a default. This may include missed payments or failure to adhere to other terms.

- Governing Law: State that the agreement will be governed by Florida law. This ensures clarity on legal matters.

- Signatures: Ensure both parties sign the document. Without signatures, the note may not be enforceable.

- Record Keeping: Keep a copy of the signed note for your records. It’s crucial for tracking payments and resolving disputes.

Understanding these elements can help both lenders and borrowers navigate the lending process effectively. A well-prepared Promissory Note can protect both parties and clarify expectations.