Common mistakes

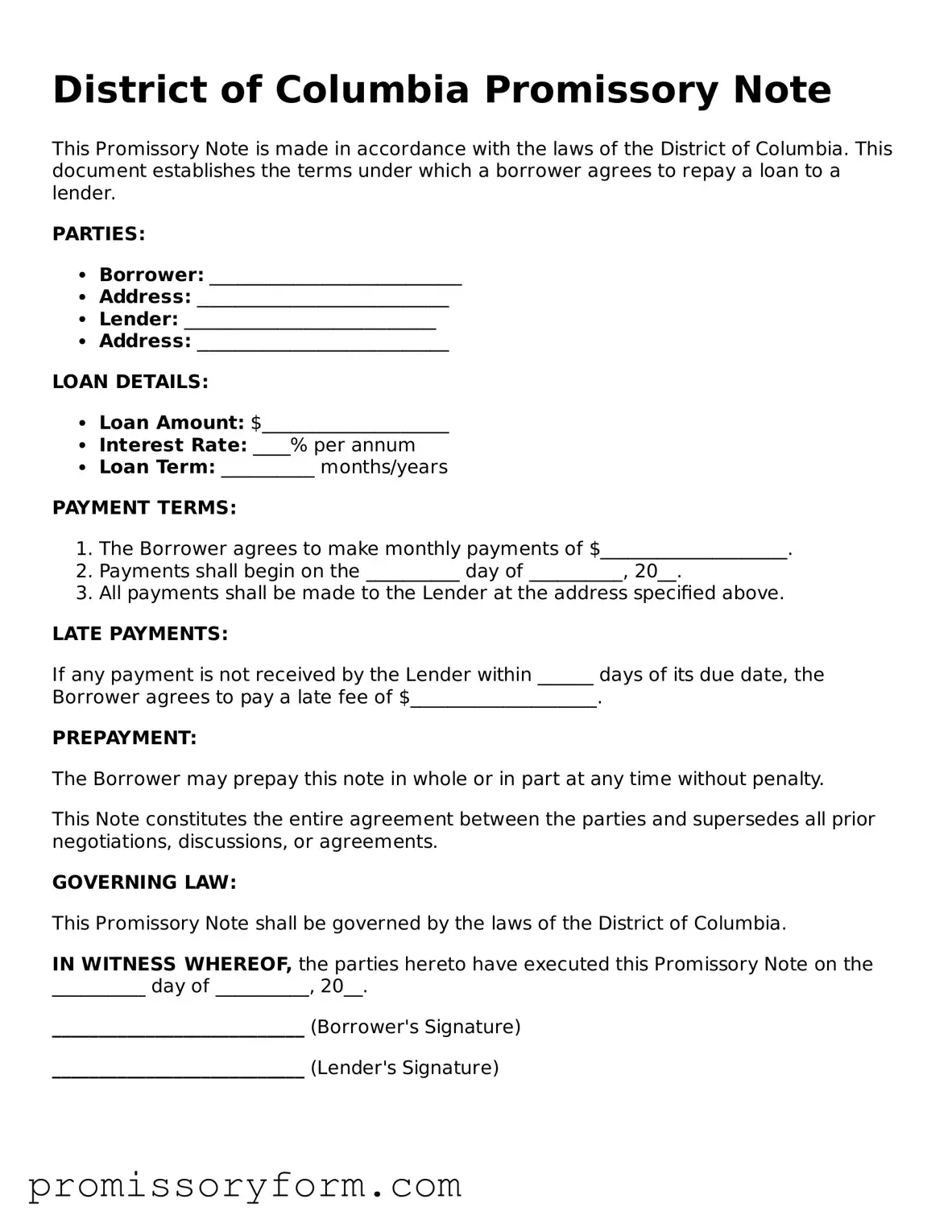

Filling out the District of Columbia Promissory Note form can be straightforward, but several common mistakes can lead to complications. One frequent error is failing to include all necessary information. The form requires specific details such as the names of the parties involved, the amount borrowed, and the repayment terms. Omitting any of these can render the note incomplete.

Another mistake is incorrect spelling or inaccurate information. Names, addresses, and dates must be precise. A small typo can create confusion and may even affect the enforceability of the note. Double-checking all entries before submission is essential to avoid this issue.

People often overlook the importance of signatures. Both the borrower and lender must sign the document. Without these signatures, the note lacks legal validity. In some cases, witnesses or notarization may also be required, depending on the situation.

Misunderstanding the repayment terms is another common error. The form should clearly outline how and when the borrower will repay the loan. Ambiguities in this section can lead to disputes later on. Clarity is key in defining the repayment schedule, interest rates, and any penalties for late payments.

Some individuals fail to consider the consequences of default. It is crucial to include provisions that address what happens if the borrower cannot repay the loan. This could involve specifying late fees or outlining the lender's rights in such situations.

Another mistake is neglecting to keep copies of the signed note. Once the document is completed, both parties should retain a copy for their records. This can be vital in case of future disputes or misunderstandings regarding the terms of the loan.

Lastly, individuals sometimes use outdated or incorrect versions of the form. Laws and requirements can change, so it is important to ensure that the most current version of the District of Columbia Promissory Note form is being used. Using an outdated form can lead to legal issues that complicate the lending process.