Key takeaways

Filling out and using a Delaware Promissory Note form can be straightforward if you keep a few key points in mind. Here are some essential takeaways to guide you through the process:

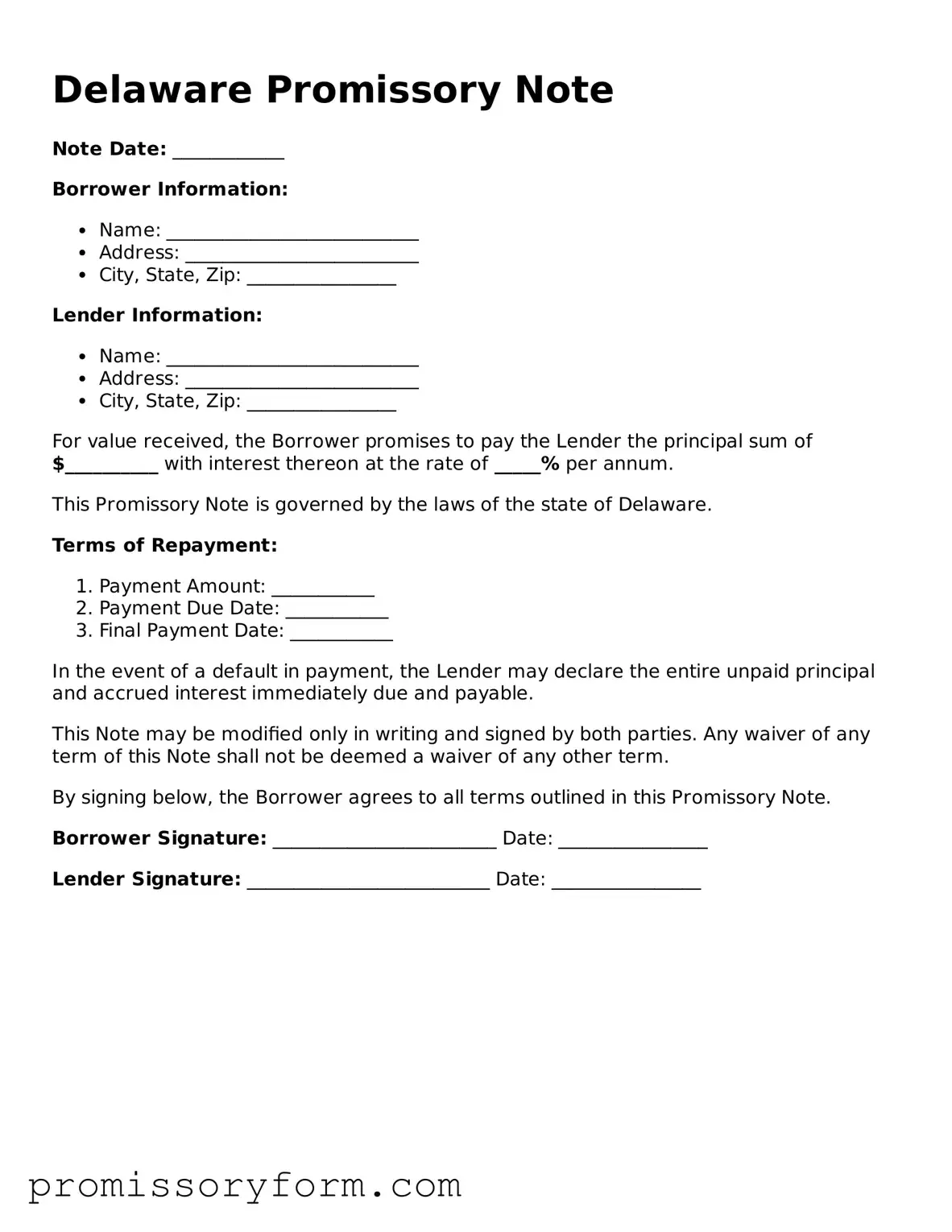

- Understand the Purpose: A promissory note is a written promise to pay a specific amount of money to a designated person or entity.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that everyone involved is properly identified.

- Specify the Amount: Clearly indicate the principal amount being borrowed. This is the total sum the borrower agrees to repay.

- Outline the Terms: Include details such as interest rates, payment schedules, and any late fees. This helps avoid misunderstandings later on.

- Include Payment Methods: Specify how payments will be made—whether by check, electronic transfer, or another method.

- Consider Collateral: If applicable, mention any collateral securing the loan. This provides additional protection for the lender.

- Signatures Matter: Both parties should sign the document. This confirms that everyone agrees to the terms outlined in the note.

- Keep Copies: Make sure to keep copies of the signed promissory note for your records. This is important for future reference.

- Seek Legal Advice: If you're unsure about any terms or conditions, consider consulting a legal professional. This can help clarify any uncertainties.

- Be Aware of State Laws: Familiarize yourself with Delaware's specific laws regarding promissory notes. This ensures compliance and validity.

By following these key points, you can effectively fill out and utilize a Delaware Promissory Note form, making the lending process smoother for both parties involved.