Key takeaways

When filling out and using the Connecticut Promissory Note form, there are several important points to keep in mind. Here are key takeaways to ensure you handle the process smoothly:

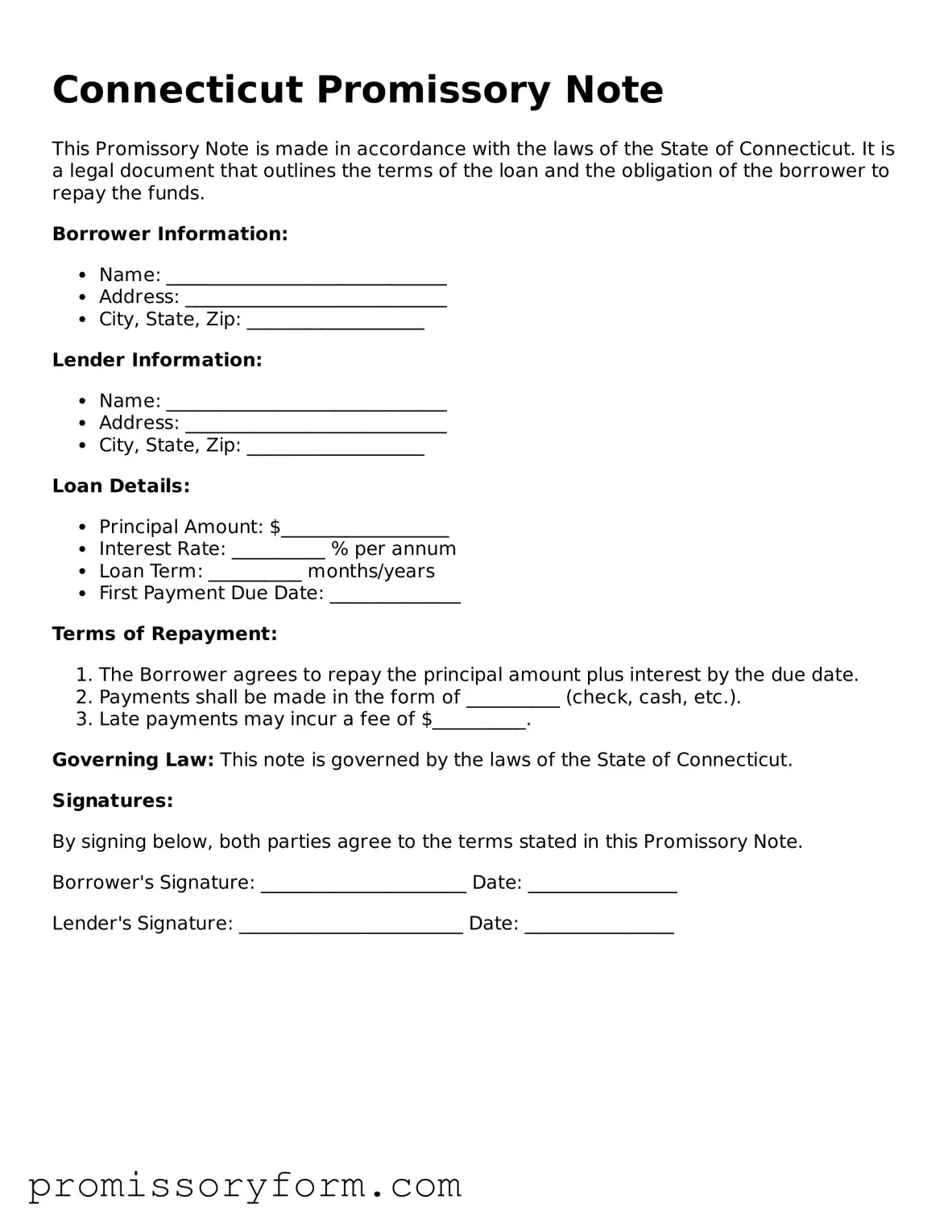

- Understand the Basics: A promissory note is a written promise to pay a specific amount of money to a designated person at a certain time.

- Include Essential Information: Make sure to provide the names and addresses of both the borrower and the lender, along with the loan amount and interest rate.

- Specify Payment Terms: Clearly outline when payments are due and the method of payment. This could include monthly installments or a lump sum payment.

- Interest Rate Clarity: State whether the interest rate is fixed or variable. This can impact the total amount paid over time.

- Consider Collateral: If applicable, mention any collateral securing the loan. This provides the lender with some protection in case of default.

- Legal Compliance: Ensure the note complies with Connecticut laws regarding interest rates and lending practices to avoid any legal issues.

- Signatures Required: Both parties must sign the document for it to be legally binding. Witnesses or notarization may be required for added security.

- Keep Copies: After completing the form, keep a copy for your records. This is essential for future reference and any potential disputes.

By following these guidelines, you can create a clear and effective promissory note that protects both the lender and the borrower.