Key takeaways

When dealing with a Colorado Promissory Note, understanding its components is crucial. Here are some key takeaways to keep in mind:

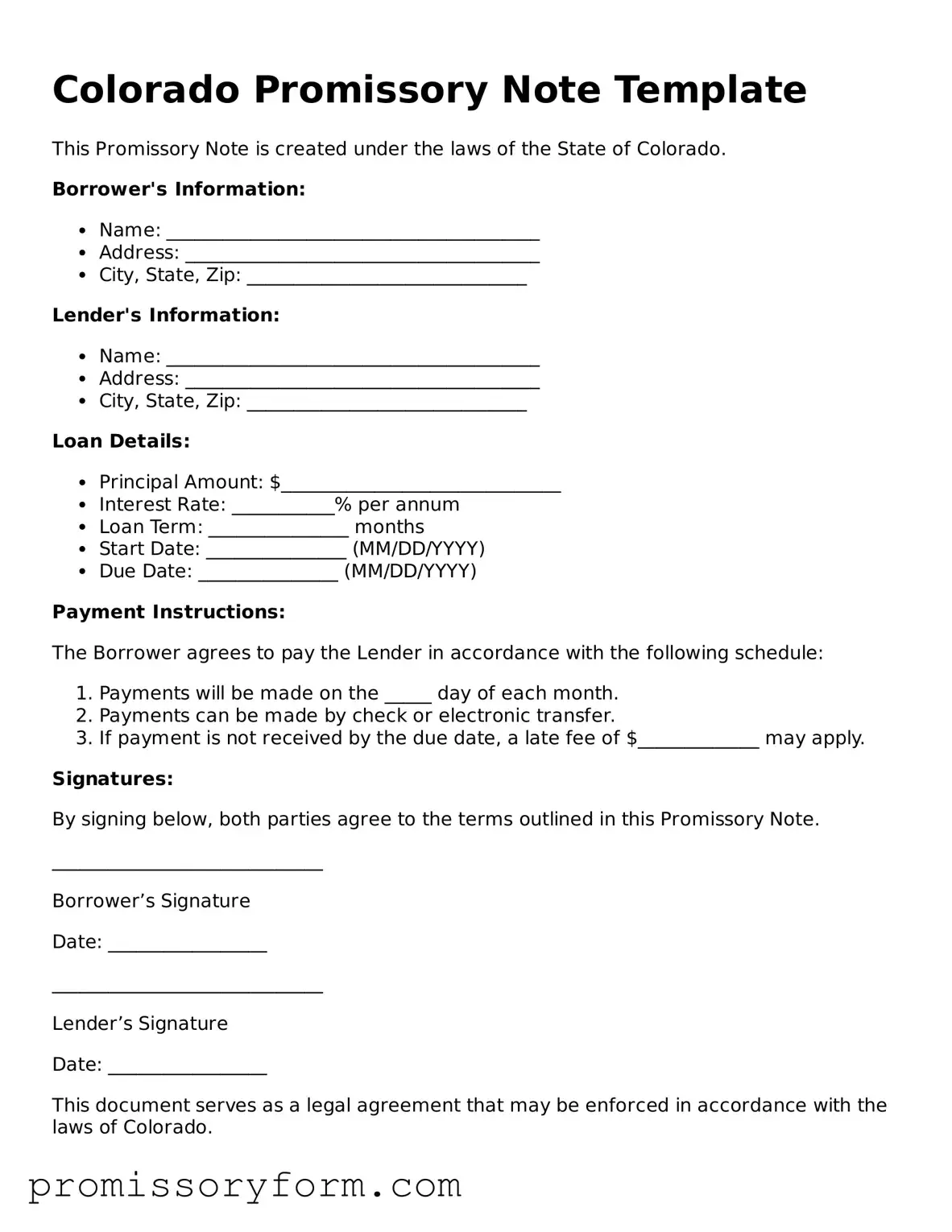

- Clear Identification: Clearly identify the borrower and lender, including their full names and addresses. This helps avoid any confusion later on.

- Loan Amount: Specify the exact amount being borrowed. This figure should be precise to prevent misunderstandings.

- Interest Rate: Include the interest rate, if applicable. Make sure it complies with Colorado state laws regarding maximum rates.

- Payment Terms: Outline the payment schedule. Indicate whether payments will be made monthly, quarterly, or in a lump sum.

- Default Terms: Define what constitutes a default. This section should clarify the consequences if the borrower fails to make payments.

- Governing Law: State that the note is governed by Colorado law. This ensures that any legal disputes will be handled under state regulations.

- Signatures: Both parties must sign the document. This step is essential for the note to be legally binding.

By following these guidelines, you can ensure that your Colorado Promissory Note is complete and enforceable. Careful attention to detail will protect both the lender and borrower throughout the loan process.