Key takeaways

When filling out and using the California Promissory Note form, there are several important points to keep in mind. These takeaways will help ensure that the document serves its intended purpose effectively.

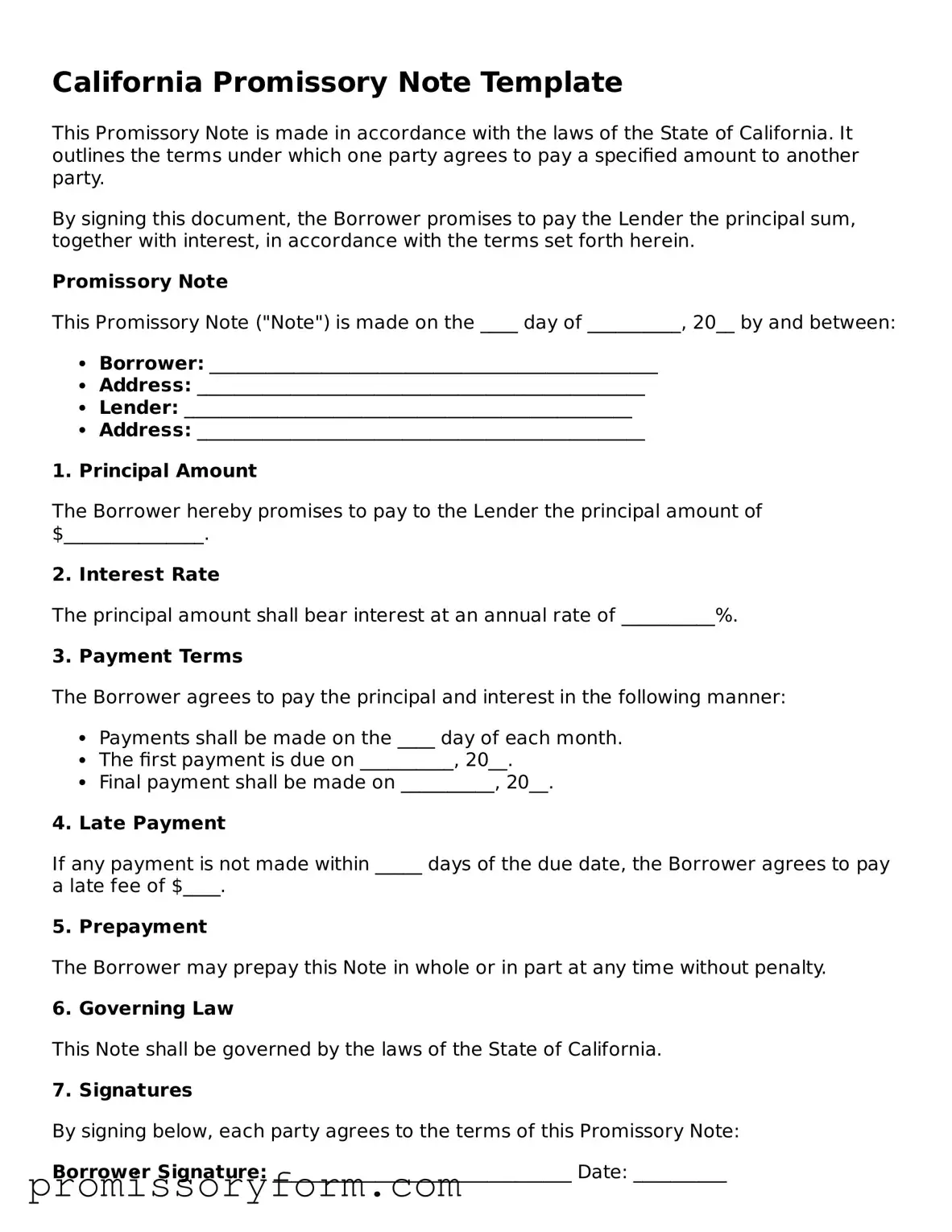

- The promissory note should clearly state the amount being borrowed. This is essential for establishing the terms of repayment.

- Include the names and addresses of both the borrower and the lender. Accurate identification helps prevent disputes later on.

- Specify the interest rate, if applicable. Clearly stating whether the loan is interest-free or carries a specific rate is crucial.

- Outline the repayment schedule. Indicate when payments are due, whether monthly, quarterly, or in a lump sum.

- Include any late fees or penalties for missed payments. This helps set expectations for both parties regarding the consequences of late payments.

- Consider adding a clause for prepayment. This allows the borrower to pay off the loan early without penalties, which can be beneficial.

- Make sure to sign and date the document. Both parties must acknowledge their agreement to the terms outlined in the note.

- Keep copies of the signed promissory note. Retaining a copy for both parties ensures that everyone has access to the agreement in case of future disputes.