Key takeaways

When dealing with financial agreements in Arkansas, it is important to understand the nuances of the Promissory Note form. Below are key takeaways that can help you navigate this process effectively.

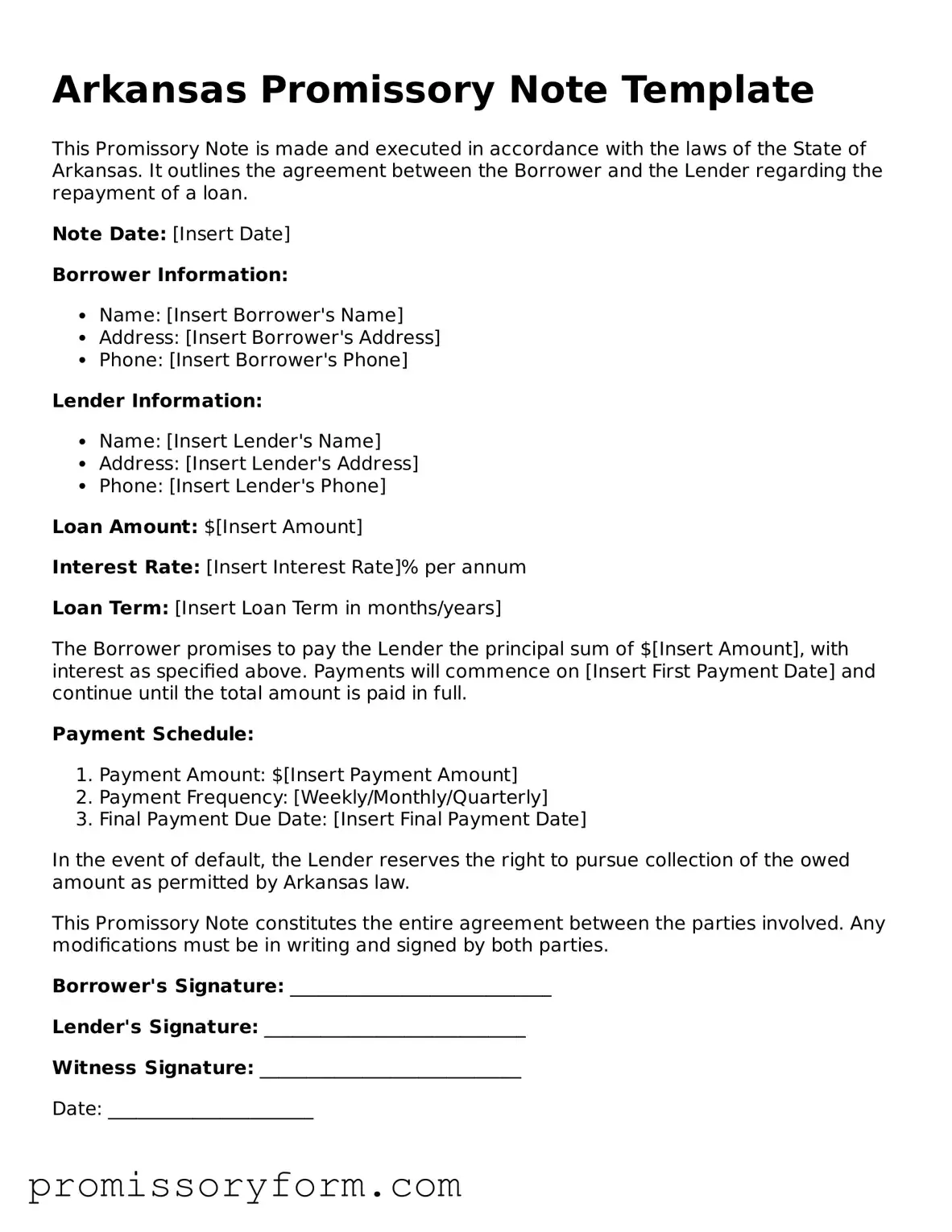

- Understand the Purpose: A Promissory Note is a legal document that outlines a borrower's promise to repay a loan to the lender under specified terms.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that both parties are easily identifiable.

- Detail the Loan Amount: Specify the exact amount of money being borrowed. This figure should be clear to avoid any confusion later.

- Set the Interest Rate: Include the interest rate, if applicable. This can be fixed or variable, but it must be clearly defined.

- Define the Repayment Terms: Outline how and when the borrower will repay the loan. Include payment frequency and due dates.

- Include Default Terms: Specify what happens if the borrower fails to make payments. This may include late fees or legal actions.

- Sign and Date: Both parties must sign and date the document. This signature signifies agreement to the terms outlined in the note.

Taking these steps seriously can help ensure that both parties are protected and that the agreement is clear and enforceable. Always consider seeking professional advice if uncertainties arise during this process.