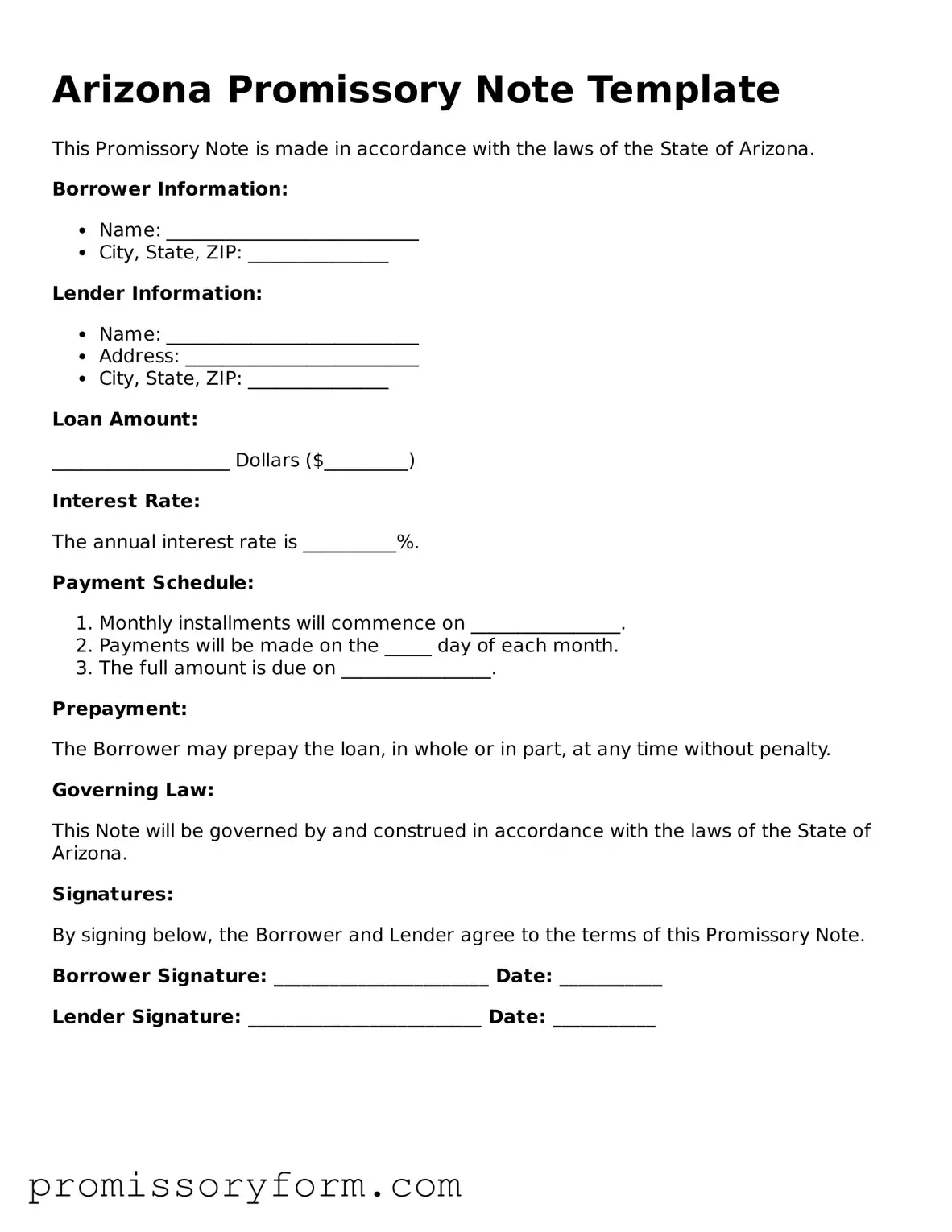

When individuals take on the responsibility of filling out the Arizona Promissory Note form, they often overlook crucial details that can lead to misunderstandings or disputes later on. One common mistake is failing to clearly identify the parties involved. It is essential to include the full names and addresses of both the lender and the borrower. Omitting this information can create ambiguity, making it difficult to enforce the terms of the agreement.

Another frequent error is neglecting to specify the loan amount. While it may seem straightforward, the exact figure must be clearly stated in both numerical and written form. This dual representation helps prevent any potential confusion regarding the amount owed. For instance, if the loan is for $10,000, it should be written as “Ten Thousand Dollars” alongside the numeral.

Many people also forget to outline the interest rate. This detail is vital, as it dictates how much the borrower will ultimately repay. Without a clearly defined interest rate, the agreement may lack enforceability. Additionally, it is important to specify whether the interest is fixed or variable, as this can significantly impact the total repayment amount.

Furthermore, the repayment schedule is often inadequately detailed. Some individuals may simply state that payments are due monthly without specifying the start date or the duration of the loan. Clarity regarding when payments begin and how long the borrower has to repay the loan can prevent future disputes and ensure both parties are on the same page.

Another common oversight is the lack of a default clause. Including terms that outline what happens if the borrower fails to make payments is crucial. This clause should detail the consequences of default, such as late fees or the potential for legal action. Without it, the lender may find it challenging to enforce their rights in the event of non-payment.

Additionally, signatories often neglect to date the document. A signature without a date can lead to questions about when the agreement was made. This is particularly important if any disputes arise regarding the timing of payments or the terms of the loan. A dated signature provides a clear timeline for both parties.

Lastly, many individuals fail to keep copies of the signed Promissory Note. After the document is completed and signed, both parties should retain a copy for their records. This ensures that each party has access to the terms of the agreement should any questions or issues arise in the future. Keeping a copy can be invaluable in protecting one’s rights and interests.