Key takeaways

When filling out and using the Alaska Promissory Note form, several key points should be considered to ensure clarity and legal compliance.

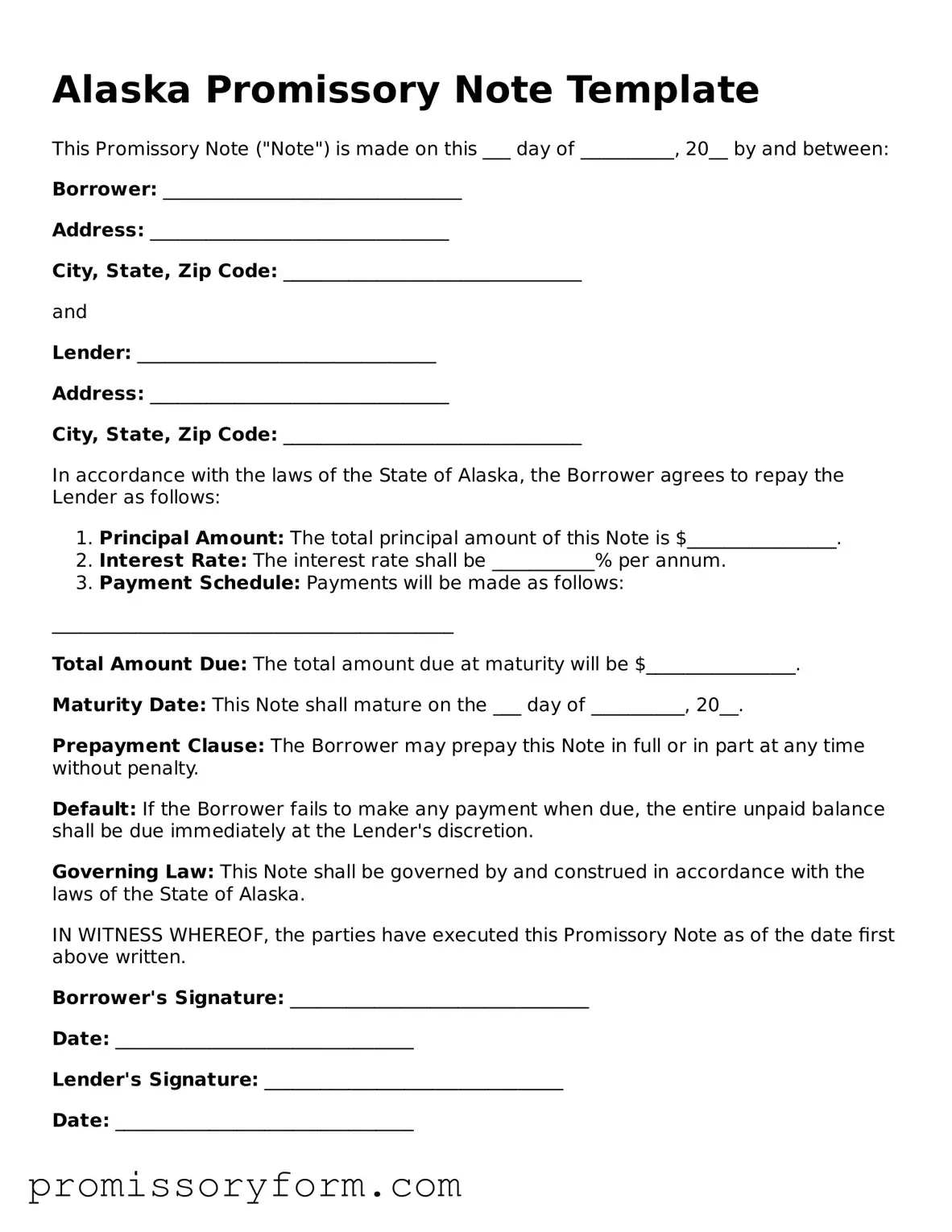

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This establishes who is involved in the agreement.

- Specify the Loan Amount: Indicate the exact amount being borrowed. This figure must be precise to avoid any confusion later on.

- Outline the Interest Rate: If applicable, include the interest rate for the loan. This should be stated as an annual percentage rate.

- Define the Repayment Terms: Clearly articulate how and when the borrower will repay the loan. Include specific dates or a schedule if necessary.

- Include Late Fees: If there are any penalties for late payments, these should be outlined in the note. This helps both parties understand the consequences of missed payments.

- State Governing Law: Specify that the agreement is governed by Alaska law. This is important for resolving any potential disputes.

- Signature Requirements: Ensure that both parties sign the document. Without signatures, the note may not be enforceable.

- Consider Notarization: While not always required, having the document notarized can provide an additional layer of authenticity and may be beneficial in case of disputes.

By paying attention to these details, both borrowers and lenders can create a clear and enforceable promissory note that protects their interests.