Key takeaways

When dealing with a Promissory Note, understanding its key components is essential for both borrowers and lenders. Here are some important takeaways to keep in mind:

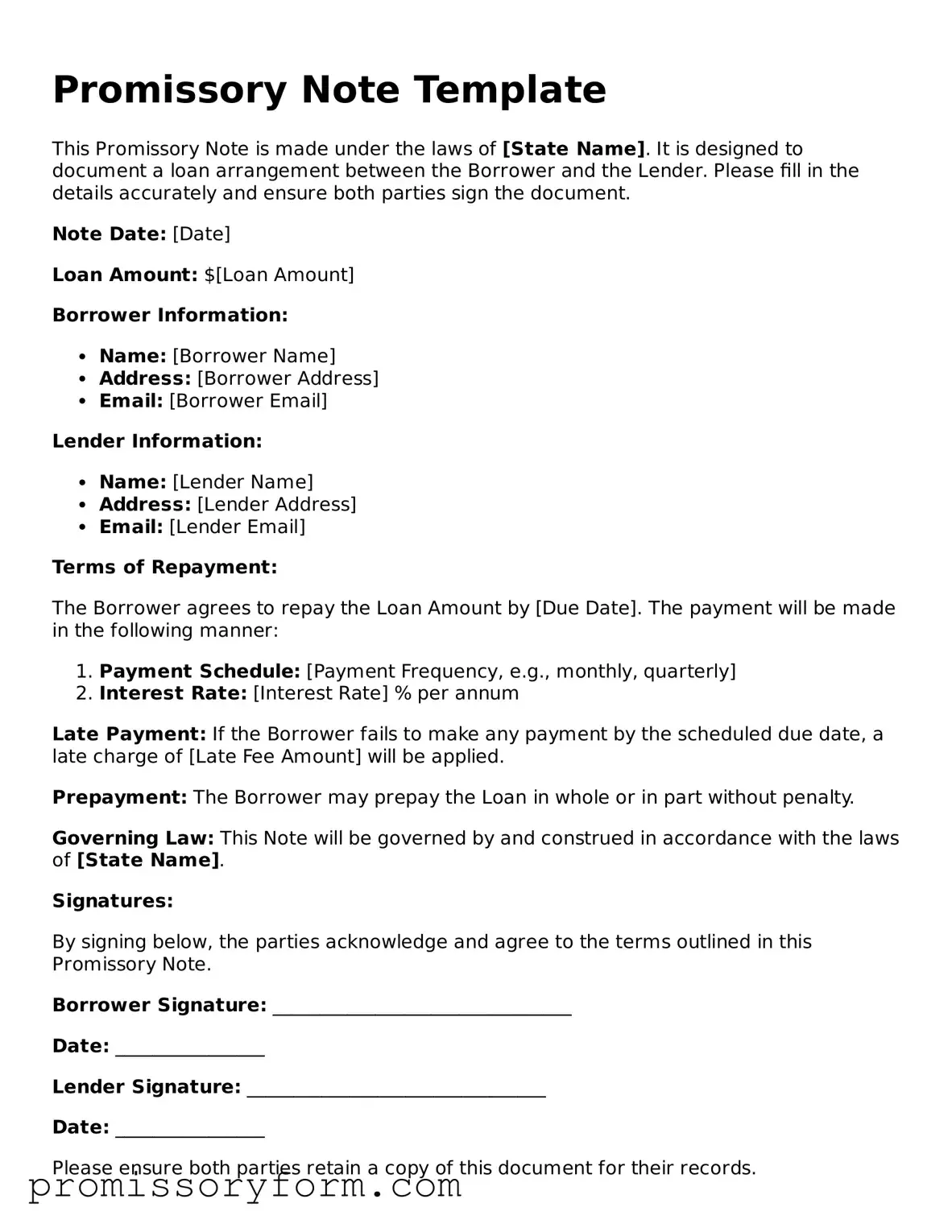

- Clarity is Crucial: Ensure that all terms, including the loan amount, interest rate, and repayment schedule, are clearly stated. Ambiguities can lead to disputes.

- Signature Requirement: Both parties must sign the document. A Promissory Note is not legally binding without the signatures of both the borrower and the lender.

- Consider Legal Compliance: Be aware of state laws governing Promissory Notes. Different jurisdictions may have specific requirements that must be followed.

- Record Keeping: Keep a copy of the signed Promissory Note for your records. This document serves as proof of the loan agreement and its terms.

- Default Consequences: Understand the implications of defaulting on the loan. The Promissory Note should outline what happens if payments are missed, including potential legal actions.

By paying attention to these aspects, both lenders and borrowers can navigate the lending process more effectively and reduce the likelihood of misunderstandings.